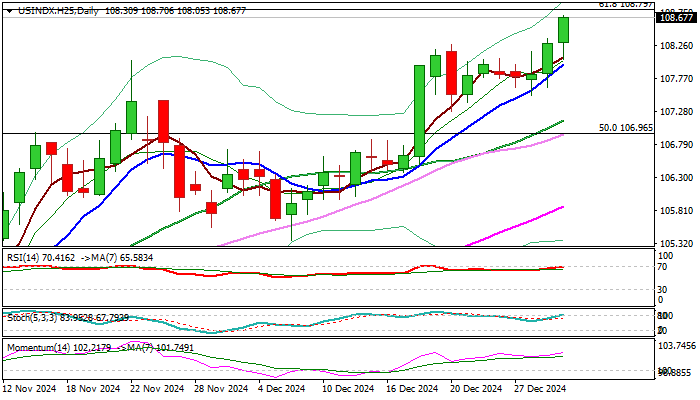

The US Dollar Index (DXY) maintained a steady trajectory at the start of the year, reflecting investor confidence amid shifting global market dynamics. Following a volatile 2024 marked by rate hikes and geopolitical tensions, the dollar’s firm stance highlights its ongoing appeal as a safe-haven asset. The index, which tracks the greenback’s performance against a basket of major currencies, showed resilience as traders positioned themselves ahead of upcoming economic data releases.

Source – FXStreet

Expectations of further monetary tightening by the Federal Reserve continue to buoy the dollar, with markets closely monitoring employment and inflation indicators. A combination of robust labor market data and persistent inflationary pressures could reinforce the Fed’s hawkish stance, keeping the US Dollar Index supported. However, any signs of economic slowdown or dovish policy shifts could temper the dollar’s strength in the coming months.