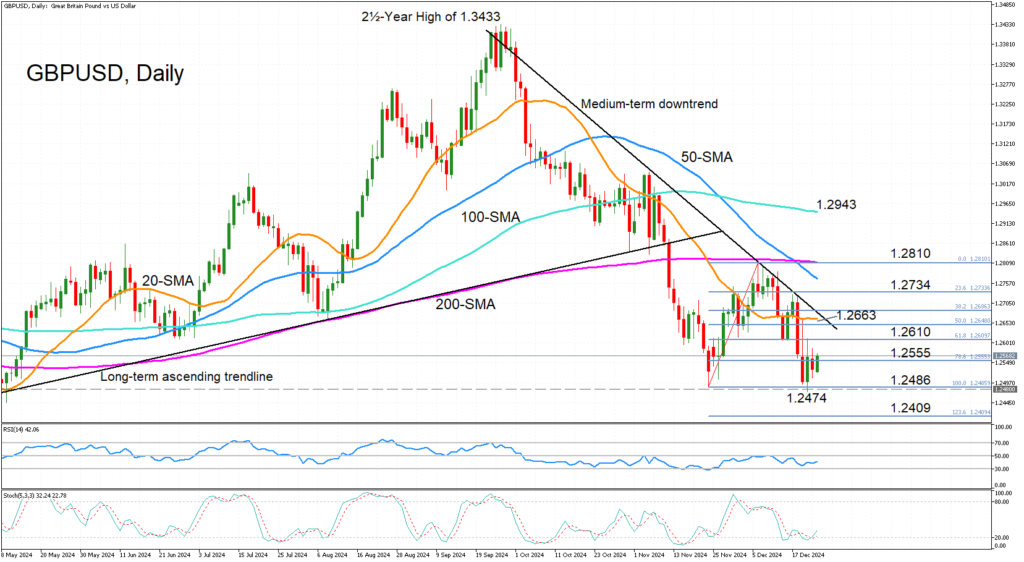

The GBPUSD pair remains above the 1.25 level, signaling a tentative show of strength despite lingering concerns over its weak bullish momentum. Traders are eyeing upcoming economic data and central bank commentary, which could influence the pair’s near-term direction. Recent market activity has seen limited follow-through on bullish attempts, reflecting a cautious stance among investors.

Source – FXStreet

Market analysts note that technical indicators suggest limited upside potential, with resistance around 1.2550 serving as a critical test for further gains. Support at 1.2450 provides some stability, but a break below this level could invite bearish pressure. The pair’s performance will likely hinge on the dollar’s strength and any shifts in risk sentiment, especially as global uncertainty weighs on forex markets.