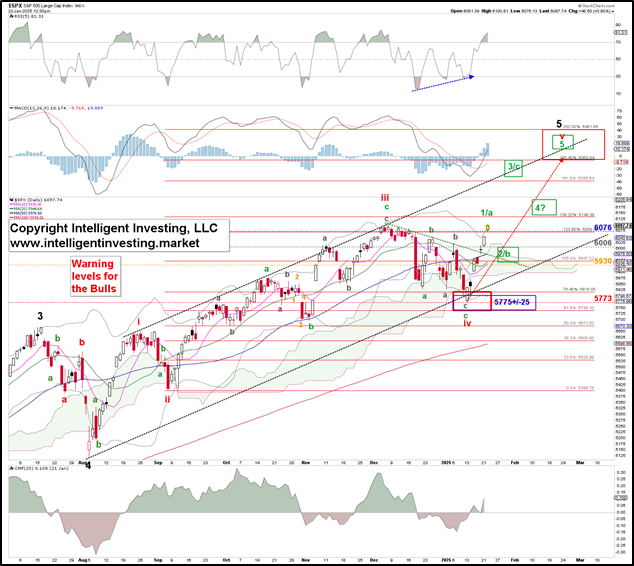

The S&P 500 is poised to reach a new high of 6,400-6,500, driven by investor optimism and a resilient economic outlook. Analysts point to robust earnings in key sectors, a steady labor market, and easing inflation as primary catalysts for the index’s upward trajectory. The projected range represents a significant leap from current levels, reflecting renewed confidence in long-term growth prospects.

Source – FXStreet

Market participants remain cautiously optimistic, balancing bullish momentum with concerns over potential interest rate hikes. While central bank policy remains a wildcard, the broader sentiment suggests that equities are likely to stay on an upward path in the near term. If realized, this would mark a historic achievement for the S&P 500, underscoring the strength of the U.S. economy.