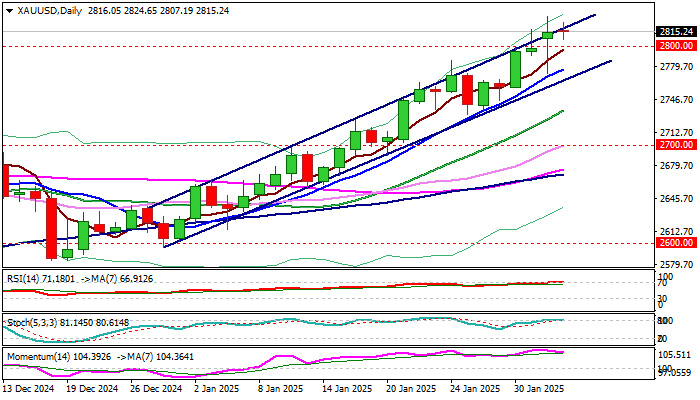

Gold (XAU/USD) extended its gains on Thursday, with bullish momentum tightening after a period of minor consolidation. The renewed upside reflects strong demand for safe-haven assets amid persistent economic uncertainties and shifting expectations around global monetary policy. Traders are increasingly positioning for further gains as technical indicators point to sustained buying interest.

The precious metal’s rally has been supported by a softer U.S. dollar and easing Treasury yields, which have reduced the opportunity cost of holding non-yielding assets like gold. Additionally, lingering concerns over geopolitical tensions and global growth prospects have fueled safe-haven demand, providing a solid foundation for gold’s upward trajectory. The metal’s ability to hold above key support levels suggests that bulls remain firmly in control.

Source – FXStreet

From a technical standpoint, gold has broken through critical resistance zones, with momentum indicators signaling room for further upside. Analysts note that if gold maintains its current pace, it could target new multi-month highs, especially if upcoming U.S. economic data reinforces expectations of a pause in the Federal Reserve’s rate hikes. Any signs of weakening economic conditions could further amplify gold’s appeal.

However, traders remain cautious as short-term volatility may arise from key macroeconomic events, including U.S. inflation data and central bank commentary. While the broader outlook favors the bulls, gold’s performance will likely hinge on the interplay between economic data, dollar strength, and shifts in risk sentiment.

In the near term, the XAU/USD pair is expected to trade with a bullish bias, supported by strong technical and fundamental factors. As global uncertainties persist, gold’s role as a reliable hedge against market volatility continues to attract investors, solidifying its upward momentum.