The EUR/USD fell below the critical 1.0400 level on Wednesday, pressured by stronger-than-expected US economic data and comments from former President Donald Trump. A robust ISM Services PMI reading, signaling continued expansion in the US services sector, bolstered expectations of a hawkish Federal Reserve stance. This heightened demand for the US dollar, leaving the euro struggling for support.

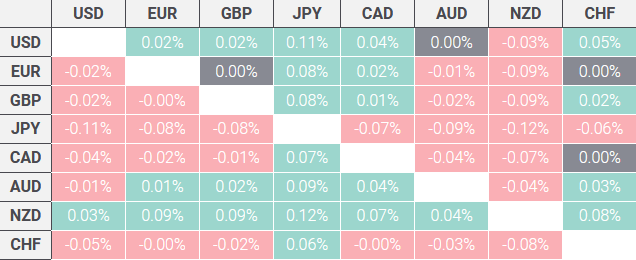

Source – FXStreet

Adding to the pressure, Trump’s remarks about the strength of the US economy under his policies reignited market chatter about potential fiscal changes, further favoring the dollar. Meanwhile, European economic data offered little relief, with persistent concerns over sluggish growth and inflation keeping the euro under strain.

Analysts view the break below 1.0400 as a potential turning point for EUR/USD, given its importance as a psychological support level. Continued dollar strength, coupled with a lack of compelling eurozone data, could see the pair testing new lows in the coming sessions. Traders will now focus on upcoming US labor market figures and the European Central Bank’s next steps for further direction.