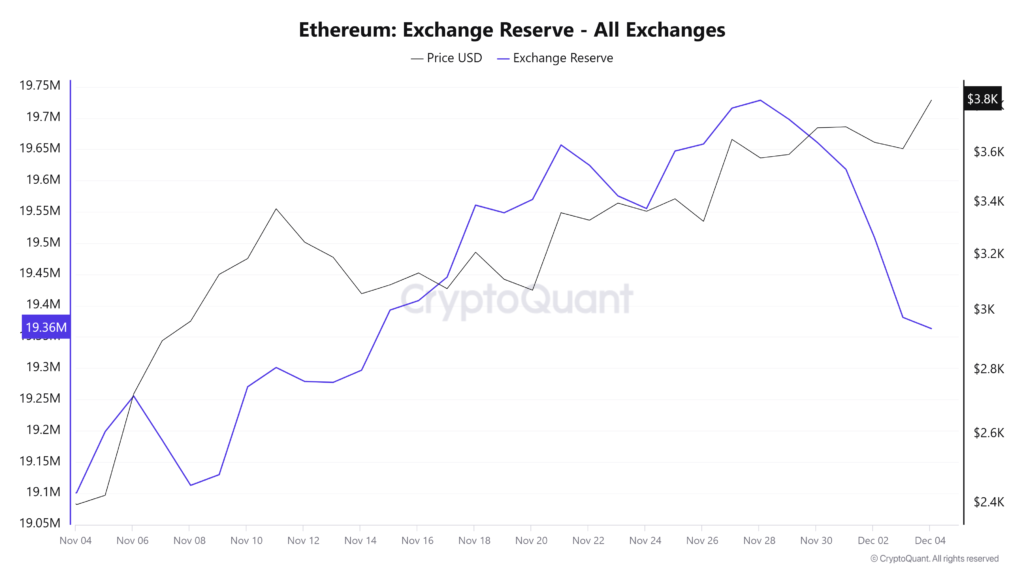

Ethereum (ETH) is regaining momentum as significant market players, known as whales, exhibit increased buying activity. Analysts suggest this surge in accumulation could drive Ethereum closer to testing its all-time high resistance of $4,868, last achieved in November 2021. This renewed interest reflects broader optimism in the crypto market, spurred by easing regulatory concerns and improving macroeconomic conditions.

Source – FXStreet

Market data highlights a substantial rise in large-scale ETH transactions, often a precursor to price rallies. If whales maintain their aggressive stance, Ethereum’s bullish trajectory could extend into the first quarter of 2024, testing key psychological levels. However, experts warn of potential volatility as external factors, including Federal Reserve policies and Bitcoin’s performance, continue to influence the market’s direction.

Source – FXStreet

Ethereum’s outlook remains cautiously optimistic, hinging on whether whale activity sustains its momentum. A successful break above the $4,868 resistance could signify a new phase of growth for the second-largest cryptocurrency by market capitalization.