The US dollar lost ground against the Canadian dollar, with USD/CAD struggling below 1.4250, as a combination of weaker US economic sentiment and rebounding oil prices provided support for the Canadian dollar. Market participants continue to adjust their positions based on shifting expectations for Federal Reserve policy and the global demand outlook for crude oil.

The US dollar remains under pressure, with renewed speculation that the Federal Reserve may ease its monetary stance sooner than expected. Recent economic data has pointed to slowing growth and moderating inflation, prompting traders to price in a higher probability of rate cuts later this year. This has led to a pullback in Treasury yields, further weighing on the dollar and limiting its strength against the Canadian dollar.

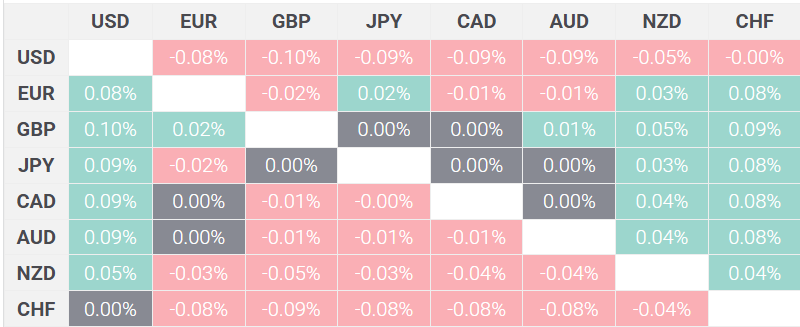

US Dollar against Swiss Franc as of February 25th, 2025 (Source: FXStreet)

Meanwhile, oil prices have rebounded, providing support to the commodity-linked Canadian dollar. Crude oil, a key export for Canada, has regained traction as markets digest potential supply constraints and signs of steady global demand. Higher oil prices typically strengthen the loonie, making it more attractive relative to the US dollar in currency markets.

From a technical standpoint, USD/CAD is struggling to gain momentum, with 1.4250 acting as a resistance level. A break below 1.4200 could reinforce downside momentum, while a rebound above 1.4280 might indicate a temporary recovery for the pair. However, the broader trend suggests limited upside potential unless the US dollar regains strength.

Looking ahead, traders will be closely watching upcoming US inflation data and Federal Reserve commentary, as well as developments in the oil market. Any signs of weaker inflation in the US could accelerate dollar weakness, further benefiting the Canadian dollar. Conversely, stronger-than-expected data could stall the loonie’s advance, pushing USD/CAD higher.

For now, USD/CAD remains pressured, with oil market recovery and weaker US rate expectations keeping the pair below key resistance levels. Unless a shift in market sentiment occurs, the Canadian dollar may continue to hold its advantage in the near term.