Japan’s stock market in 2024 showed impressive gains in yen terms, driven by a wave of corporate reforms and improved investor sentiment. However, when viewed from the perspective of international investors, these gains were largely erased by a weakened yen, which tumbled more than 12% against the U.S. dollar. While domestic shareholders benefited, foreign investors faced underwhelming returns, highlighting the challenges of exchange rate volatility in global markets.

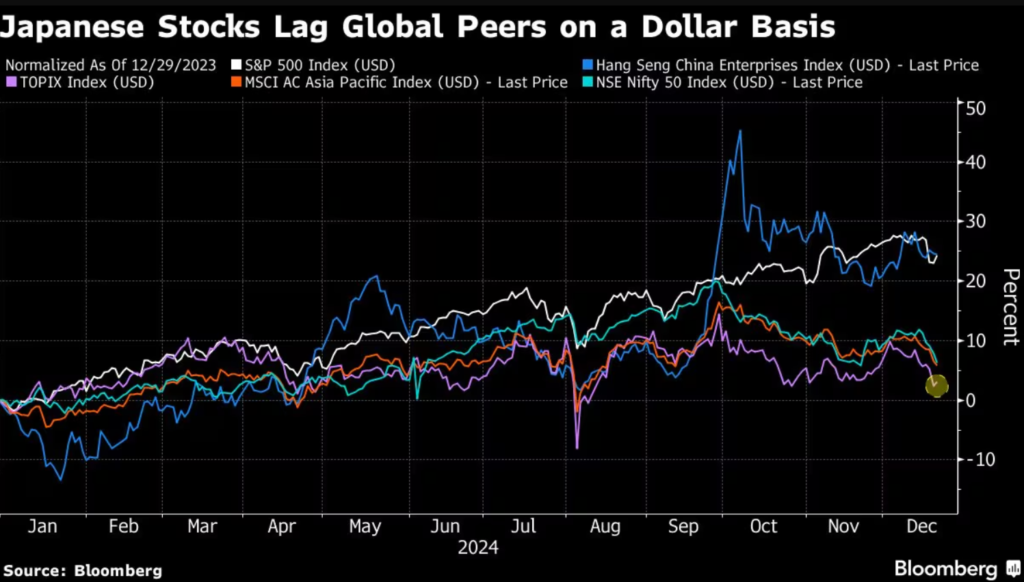

The Topix index surged over 20% in local currency, outperforming many global peers. Yet, in dollar terms, the rally translated to just around 7%, a stark reminder of how currency movements can diminish overseas gains. Analysts noted that Japan’s focus on higher shareholder returns and governance improvements spurred local optimism, but the yen’s drop largely negated these benefits for foreign participants.

While the Bank of Japan maintained an ultra-loose monetary policy, fueling local equities, it inadvertently weakened the yen further. The central bank’s commitment to low interest rates contrasted sharply with tightening policies in the U.S., making the dollar more attractive for investors. This divergence underscored the complex dynamics of currency and stock market performance.

Despite the hurdles, global funds still poured into Japanese equities, recognizing long-term potential. However, the disappointing dollar returns may dampen future enthusiasm unless the yen stabilizes. As 2025 approaches, the interplay between Japan’s market reforms and its currency will be closely watched by investors seeking to balance risks and rewards.