The Australian dollar held steady on Wednesday, buoyed by a stronger-than-expected trade surplus that helped offset broader market uncertainty. The upbeat data reinforced confidence in the domestic economy and offered support to the currency despite lingering global headwinds.

Australia’s trade surplus came in well above market forecasts, driven by robust exports of key commodities such as iron ore and coal. The figures suggest sustained external demand, particularly from China, which remains Australia’s largest trading partner.

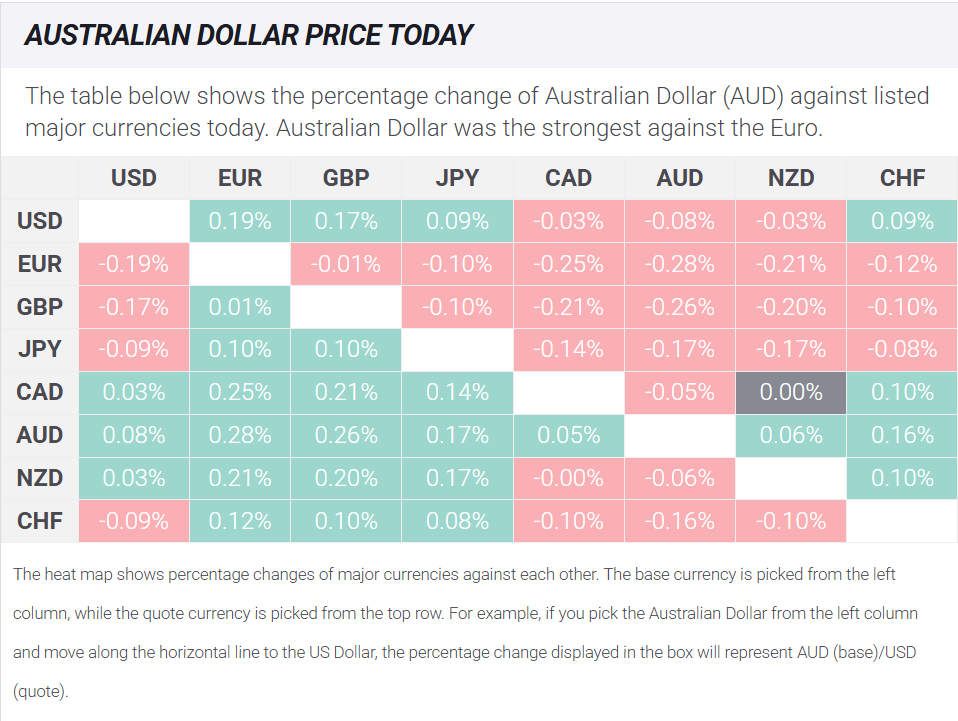

The Aussie dollar traded near recent highs, shrugging off modest gains in the US dollar amid mixed risk sentiment. While market participants remain wary of global growth risks, the strength in Australia’s external accounts has helped keep AUD demand intact.

Investors are also watching for additional economic data that could shape the Reserve Bank of Australia’s rate outlook. Although the central bank remains cautious, signs of economic resilience may temper the case for further easing.

For now, the Aussie remains supported, with traders eyeing global developments—especially from China and the US—for any signals that could shift momentum.