-

Meta Platforms benefits from strong long-term growth drivers.

-

Nvidia’s next-gen GPUs will be made in the U.S., reducing tariff risks.

-

10 stocks we like better than Meta Platforms ›

AI investing still stands tall—even amid tariff risks

Artificial intelligence (AI) investing isn’t entirely immune to tariff impacts. Tariffs on components entering the U.S. could raise costs, while weaker consumer demand might affect AI capital expenditures. Still, some stocks are positioned to perform well over the long haul, regardless of short-term headwinds like tariffs.

Here are two such stocks that investors can confidently buy and hold for 3 to 5 years.

Meta Platforms

Meta Platforms (NASDAQ: META) is essentially an advertising powerhouse, generating 98% of its revenue from ads across Facebook and Instagram. It uses its strong cash flows to invest heavily in AI, helping it advance ad targeting technologies and develop cutting-edge consumer tech.

While tariffs might create initial economic headwinds that slow ad revenue, Meta’s core business remains resilient and is likely to weather the storm over the next few years.

AI-powered innovations like Meta’s smart glasses could become game-changers. Even if these don’t pan out, Meta’s base business provides enough investment merit on its own to justify buying now—regardless of what happens with tariffs.

Meta is also attractively valued. Though it was a better deal a few weeks ago during a market dip, it’s still trading on the lower end of its 12-month range.

Even after the market rebound, Meta still looks like a solid long-term investment, and now may be a great time to start a position.

Nvidia

Nvidia (NASDAQ: NVDA) might seem like an odd pick considering its global chip sourcing, but that’s changing. Nvidia has revealed that its next-gen Blackwell GPUs will be 100% U.S.-produced by 2026. Chips will originate from TSMC’s Arizona plant and be assembled at Foxconn and Wistron facilities in Texas—safeguarding them from tariff exposure.

Demand for GPUs remains robust, with hyperscalers still expanding their AI data centers. As early-generation GPUs wear out, clients will need to replace them with newer models. Data center spending is forecasted to climb from $400 billion in 2024 to $1 trillion by 2028, which should give Nvidia a powerful growth tailwind.

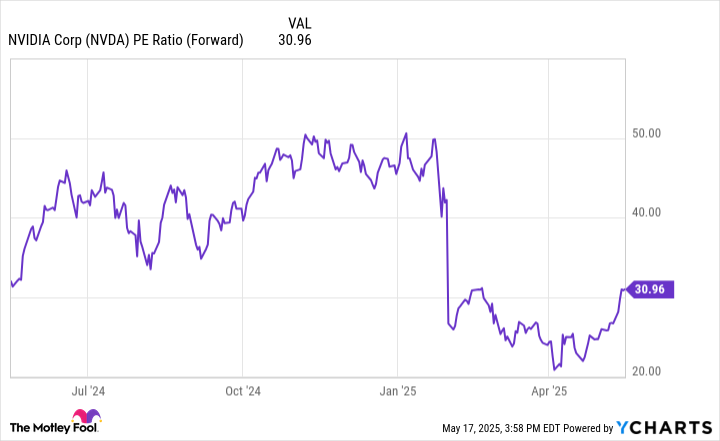

Like Meta, Nvidia has rebounded but still trades below its 2024 highs.

With a forward P/E of 31, Nvidia isn’t “cheap,” but its growth trajectory justifies buying even at current levels.

Should you invest $1,000 in Meta Platforms right now?

Before diving into Meta Platforms stock, consider this:

The Motley Fool Stock Advisor team just revealed 10 stocks they believe are better buys than Meta. These stocks are poised for potentially massive returns in the coming years.

To illustrate: If you’d bought Netflix when it was recommended in December 2004, your $1,000 investment would now be worth $642,582. The same goes for Nvidia in April 2005, which would’ve grown a $1,000 investment to $829,879.

Stock Advisor’s average return stands at 975%, far outperforming the S&P 500’s 172%.

Don’t miss the next top 10 picks—available now to Stock Advisor members.