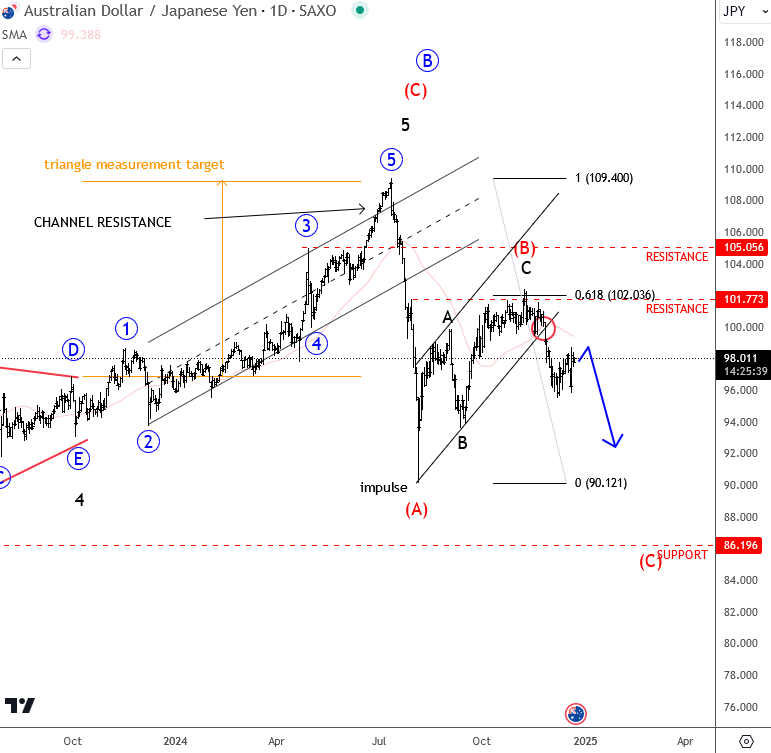

The AUD/JPY pair remains under pressure as risk-off sentiment dominates global markets. Concerns over global economic slowdown, coupled with hawkish signals from the Bank of Japan, have weighed heavily on the pair. The Australian dollar, often linked to commodity strength and risk appetite, has struggled to gain traction as market participants favor the yen’s safe-haven appeal.

Source – FXStreet

Analysts suggest the pair may see further downside if risk-averse conditions persist. The yen’s renewed strength follows reports that Japan’s central bank could adjust its monetary policy, reinforcing its hawkish stance. Meanwhile, Australia’s reliance on exports and vulnerability to Chinese economic developments may keep the AUD/JPY subdued in the near term.

While technical indicators hint at oversold levels, traders remain cautious. A decisive shift in global sentiment or supportive Australian economic data could provide relief, but the outlook remains tilted to the downside for now.