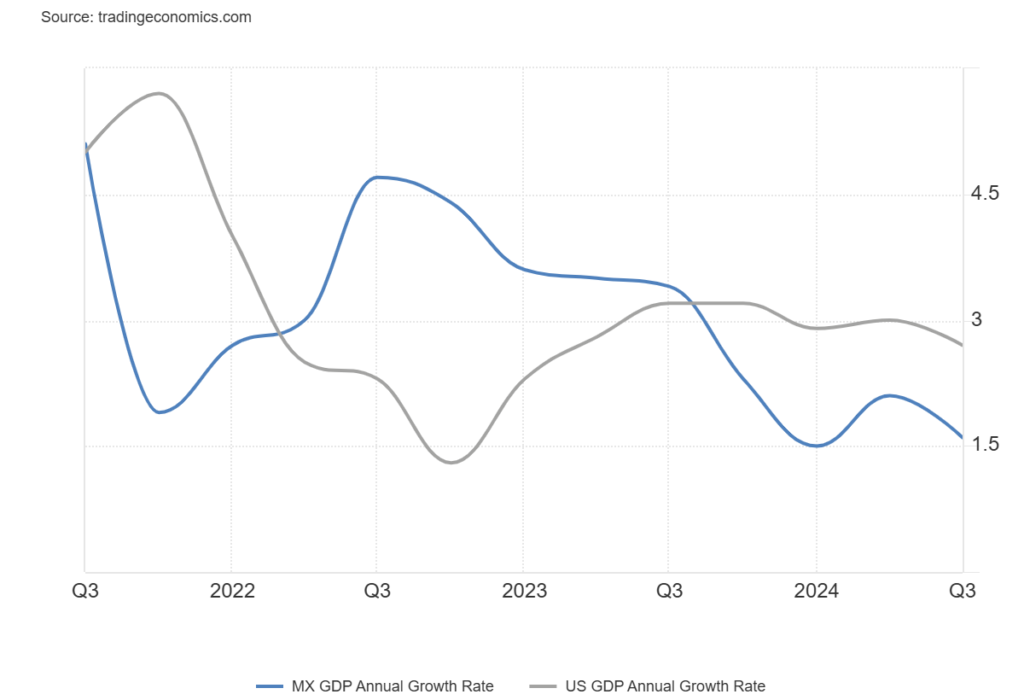

The USD/MXN exchange rate is poised for a volatile year in 2025 as economic headwinds, monetary policy shifts, and political developments weigh on the Mexican Peso. Analysts anticipate that Mexico’s slowing economic growth will amplify currency pressures, with forecasts suggesting a modest GDP expansion below expectations. Meanwhile, the U.S. Federal Reserve’s monetary policy trajectory could add to the Peso’s challenges, particularly if higher interest rates strengthen the dollar.

Source – FXStreet

Mexico’s central bank is expected to maintain a cautious stance, with policymakers likely prioritizing inflation containment over aggressive rate cuts. Adding complexity, former U.S. President Donald Trump’s renewed political prominence could reintroduce uncertainty, particularly regarding trade relations and immigration policies. These factors could unsettle investors and spur further volatility in the USD/MXN pair, particularly if geopolitical tensions rise.

With a mix of domestic and international pressures, the Peso’s trajectory remains uncertain. Traders will closely monitor monetary policy signals and political developments for clarity on the currency’s path forward.