The USD/CHF pair continues to gain traction as investors anticipate stronger performance from the U.S. economy, supported by robust labor market data and renewed consumer confidence. The Swiss franc, often viewed as a safe-haven currency, has seen reduced demand as global risk sentiment improves, further fueling the dollar’s rise. Analysts suggest the pair is heading toward key resistance levels, indicating potential for further gains.

Recent statements from the Federal Reserve suggest a steady interest rate policy, adding to the dollar’s appeal. Meanwhile, Swiss economic data has shown signs of stagnation, with weak retail sales and manufacturing activity pressuring the franc. This divergence in economic momentum between the U.S. and Switzerland has amplified bullish sentiment on the USD/CHF pair.

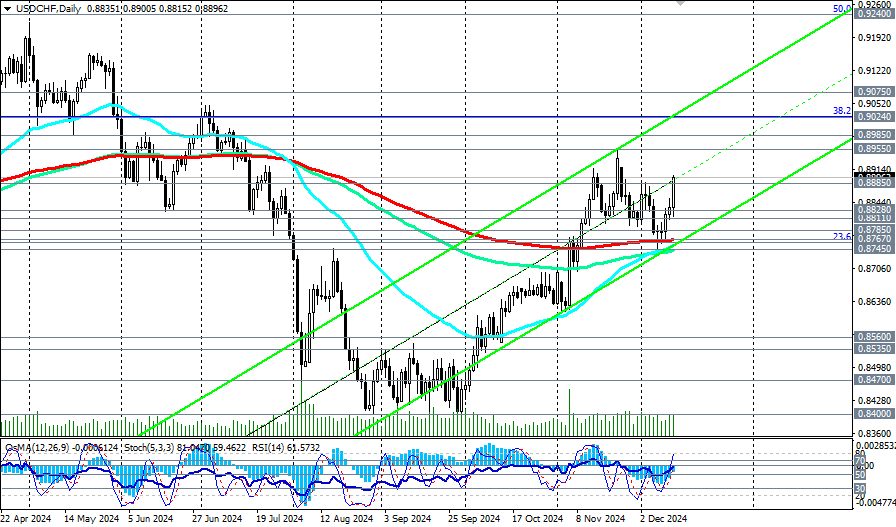

Source – FXStreet

Market participants are also eyeing geopolitical developments, which could further influence currency movements. The ongoing reduction in eurozone inflation adds indirect support to the dollar as it strengthens relative to regional currencies tied to the franc. Traders may see increased volatility, especially with key U.S. inflation data expected later this week.

While USD/CHF growth remains promising, short-term risks persist. A sudden shift in risk appetite or unexpectedly dovish Fed commentary could reverse recent gains. Investors are advised to monitor economic indicators closely as the pair approaches critical technical thresholds.