OPEC has lowered its global oil demand forecast for the third consecutive time this year, citing slower-than-expected economic growth in key markets. The cartel’s monthly report highlights challenges stemming from persistent inflation and rising interest rates, which are dampening consumption. This revision reflects growing caution among producers about the balance of supply and demand in 2024.

Global energy markets have reacted cautiously to OPEC’s announcement, with crude prices slipping slightly in early trading. The reduction in demand expectations comes amid signs of weakening industrial activity in Europe and Asia, along with subdued growth in the U.S. While OPEC members have tightened production to stabilize prices, concerns over demand destruction loom large.

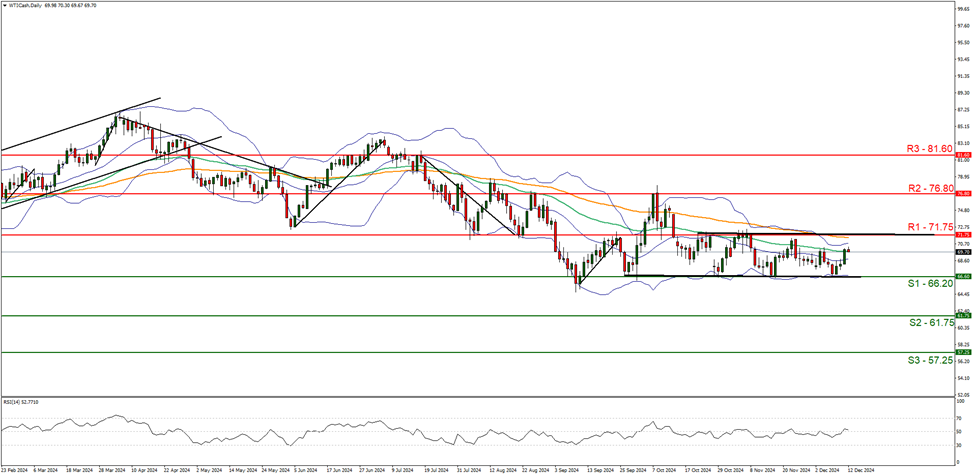

Source – FXStreet

Analysts note that OPEC’s conservative outlook underscores the uncertainty surrounding global economic recovery. With China’s post-pandemic rebound losing steam and Western economies battling inflation, oil markets face mounting pressure. These trends have prompted speculation that OPEC could implement further production cuts to avoid a supply glut.

OPEC’s revised forecast raises questions about the long-term trajectory of oil markets as renewable energy gains traction. While the group maintains efforts to balance the market, the shift toward cleaner energy sources and evolving consumption patterns could reshape demand dynamics in the coming years.