The Australian dollar (AUD) remained stable on Wednesday, while the US dollar (USD) weakened slightly ahead of the anticipated release of Purchasing Managers’ Index (PMI) data. Investors are closely eyeing the upcoming PMI figures, which are expected to provide critical insights into the state of the U.S. economy and could influence currency movements.

The AUD has maintained its strength, buoyed by a stable domestic economy and strong demand from China for commodities. On the other hand, the USD has experienced some softness as market participants reassess the outlook for the U.S. economy, particularly in light of the Federal Reserve’s potential policy shifts regarding interest rate hikes.

The soon-to-be-released PMI data will serve as a key indicator of U.S. economic performance. Should the data come in weaker than expected, it could add more pressure on the USD, as it may signal slowing economic activity, diminishing the likelihood of further aggressive monetary tightening by the Fed.

Meanwhile, the Australian dollar continues to be supported by favorable economic conditions, though it remains vulnerable to changes in global risk sentiment. With inflationary concerns still looming and central banks around the world navigating a tricky path between fostering growth and controlling inflation, traders are approaching the market with caution.

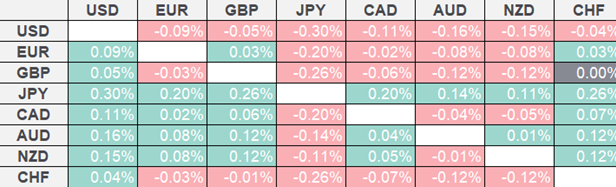

(SOurce: FXStreet)

Currently, the AUD/USD pair is holding near important levels, with the release of the PMI data expected to provide direction for short-term market movements. Investors will be closely watching to see if the PMI aligns with current forecasts or introduces new risks that could shift currency trends. As the day progresses, both the AUD and USD are likely to face potential volatility depending on the outcome of the PMI reports. Traders are preparing for the possibility that the data could reshape market expectations for both currencies in the near term.