FTSE 100 Aims to Recover Recent Losses

The FTSE 100 is attempting to recover from last week’s losses, which were exacerbated by a sell-off due to European election turmoil. The UK blue-chip index is trading back above its 55-day simple moving average (SMA) at 8,173, with Thursday’s high of 8,220 in sight.

A decline through Friday’s low of 8,112 could target the 8,095 to 8,017 range, which includes early and mid-April highs and the late May low. For the bulls to regain control, a rise above Tuesday’s high of 8,266 is necessary.

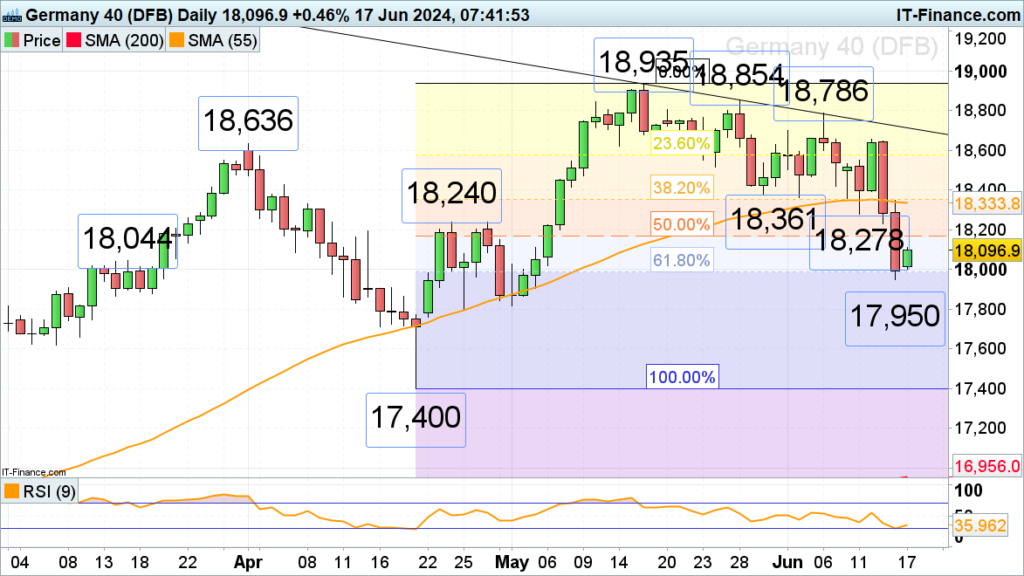

DAX 40 Stabilizes Above Six-Week Low

The DAX 40 is attempting to hold above Friday’s low of 17,950, which was triggered by a sell-off following a significant shift to the right in European elections and the announcement of French snap legislative elections. Friday’s low nearly touched the 61.8% Fibonacci retracement of the April-to-May advance at 17,988.

If the index falls through this level, the mid-March low at 17,865 might be targeted next. Resistance is at the 50% retracement at 18,170, followed by the late April high at 18,240.

CAC 40 Attempts to Bounce Back from Multi-Month Low

Last week, the French CAC 40 index dropped over 5%, reaching 7,464 amid significant outflows due to upcoming snap legislative elections announced by President Emmanuel Macron. The 200-day simple moving average (SMA) at 7,619 is a short-term target but is likely to act as resistance.

Above it lies the 7,704 late January high. A fall through 7,464 could see the December peak at 7,653 offer support. Failing that, a drop toward the 7,281 January low may occur.