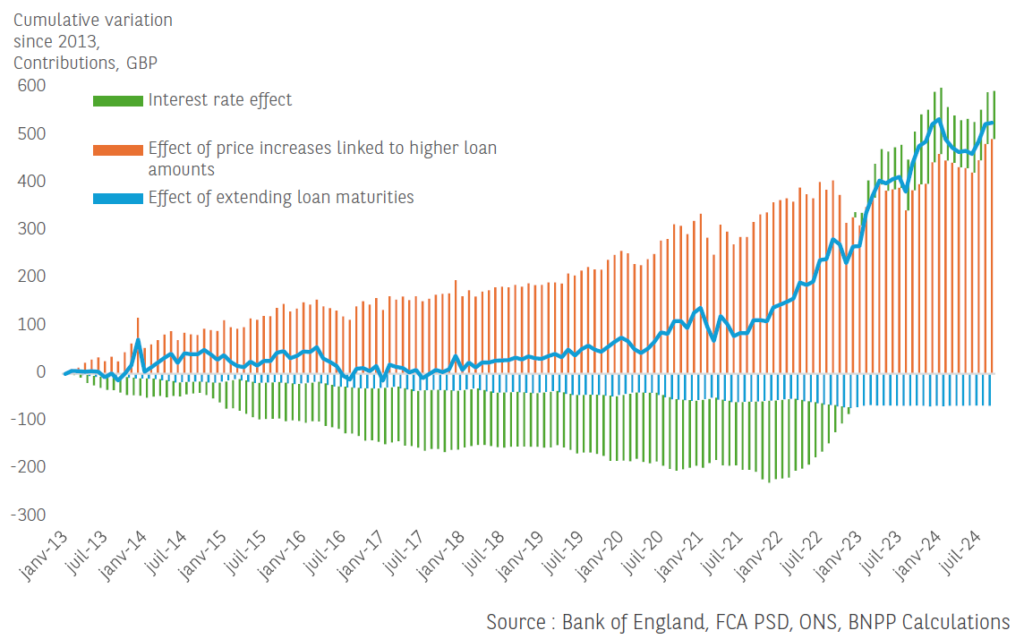

Proposals to extend mortgage loan maturities are reigniting debates about their effectiveness in addressing housing affordability. Advocates argue that longer repayment periods can lower monthly payments, enabling more individuals to qualify for home loans. However, critics contend that such measures could inflate housing prices and saddle buyers with prolonged debt burdens, diminishing long-term financial stability.

Financial institutions and policymakers are considering these adjustments amidst rising home prices and interest rates, which have put ownership out of reach for many. By stretching repayment terms to 40 years or beyond, lenders aim to ease entry barriers. Yet, economists warn that increased borrowing capacity may drive demand, pushing prices even higher.

The long-term impact on affordability remains uncertain. While easing short-term payment pressures, the potential for higher cumulative interest costs raises concerns about the true benefits of this strategy. Policymakers face the challenge of balancing immediate relief with sustainable housing market solutions.