Interactive Brokers Review

Interactive Brokers is a prominent online brokerage firm known for its extensive range of trading products and global market access. Founded in 1977 by Thomas Peterffy, the company has grown to become a leading platform for both individual and institutional investors.

In this comprehensive review, we will explore Interactive Brokers’ key features, including its diverse account types, deposit and withdrawal procedures, and fee structures. By combining expert analysis with real user experiences, this evaluation aims to provide a balanced perspective, helping you make an informed decision about whether Interactive Brokers is the right brokerage service for your investment needs.

What is Interactive Brokers?

Interactive Brokers is a leading online brokerage firm that provides access to a wide range of financial markets and instruments. Founded in 1978 by Thomas Peterffy, the company has grown to serve clients worldwide, offering services in over 150 markets across 33 countries.

Our team of trading experts has found that Interactive Brokers offers a comprehensive suite of trading platforms, including the Trader Workstation (TWS) and IBKR Mobile, catering to both novice and experienced traders. These platforms are equipped with advanced tools and features that facilitate efficient trading across various asset classes.

In our experience, Interactive Brokers provides competitive pricing with low commissions and margin rates, making it an attractive choice for cost-conscious investors. The broker also offers a diverse range of investment products, including stocks, options, futures, forex, bonds, and mutual funds, allowing traders to build diversified portfolios.

Is Interactive Brokers a Safe Broker?

Interactive Brokers is regulated by top-tier financial authorities, including the U.S. Securities and Exchange Commission (SEC) and the Financial Conduct Authority (FCA) in the UK. This regulatory oversight ensures compliance with stringent financial standards, providing clients with a secure trading environment.

The broker employs advanced security measures, such as two-factor authentication and 128-bit encryption, to safeguard client accounts and personal information. These protocols help protect against unauthorized access and cyber threats, enhancing overall account security.

Client funds are held in segregated accounts, separate from the company’s operational funds, ensuring that customer assets are protected even in the unlikely event of the broker’s insolvency. Additionally, Securities Investor Protection Corporation (SIPC) coverage provides up to $500,000 protection for securities, including a $250,000 limit for cash, offering an extra layer of security for investors.

Pros and Cons of Interactive Brokers

Pros

- Extensive global market access

- Low trading fees and commissions

- Advanced trading platforms and tools

- Competitive margin rates

- Wide range of investment products

- Comprehensive research and educational resources

- Strong regulatory oversight

Cons

- Complex platform for beginners

- Inactivity fees for low-balance accounts

- Limited customer support options

- No access to certain IPOs

- Higher fees for mutual fund trades

- No cryptocurrency trading

Interactive Brokers Trading Platforms

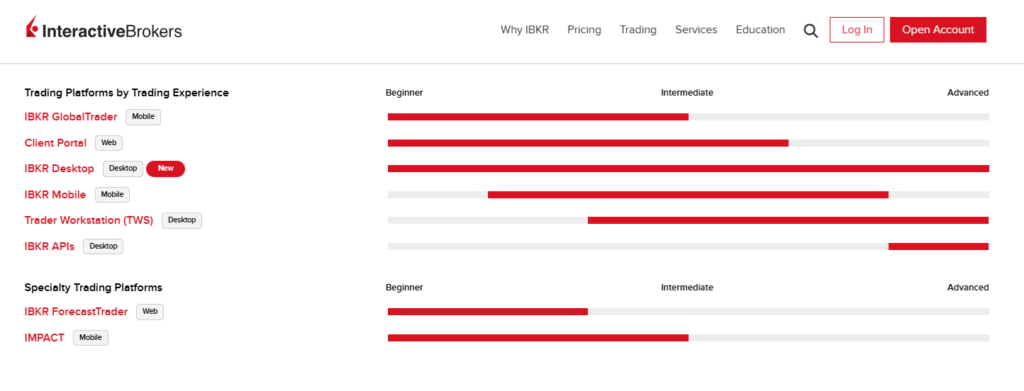

Interactive Brokers offers a variety of trading platforms tailored to different trader needs. Their flagship platform, Trader Workstation (TWS), is designed for seasoned traders requiring advanced tools and flexibility. TWS supports trading across multiple asset classes, including stocks, options, futures, currencies, bonds, and funds, on over 150 markets worldwide.

For traders seeking a more streamlined experience, IBKR Desktop combines popular tools from TWS with new features suggested by clients. This platform offers a user-friendly interface while maintaining access to a broad array of trading instruments and markets.

On-the-go traders can utilize IBKR Mobile, a platform that provides access to advanced order types and powerful trading tools. It supports trading across more than 150 markets worldwide, ensuring flexibility and convenience for active traders.

Additionally, IBKR GlobalTrader offers a simplified experience for trading stocks, ETFs, and options globally. This platform allows investments with as little as $1 and supports fractional trading, making it accessible for traders at all levels.

For those who prefer web-based access, the Client Portal provides an easy-to-use platform to view, trade, and manage accounts with a single login, without the need for downloads. This ensures that traders can efficiently monitor their investments from any device with internet access.

Interactive Brokers also offers APIs for advanced traders who wish to integrate their own systems, providing flexibility for custom trading solutions. This caters to traders with specific needs, allowing for a personalized trading experience.

Interactive Brokers Account Types

Interactive Brokers offers a variety of account types to cater to the diverse needs of individual and institutional investors. Our team of experts at Trading Insider has thoroughly researched and tested these accounts to provide you with detailed insights.

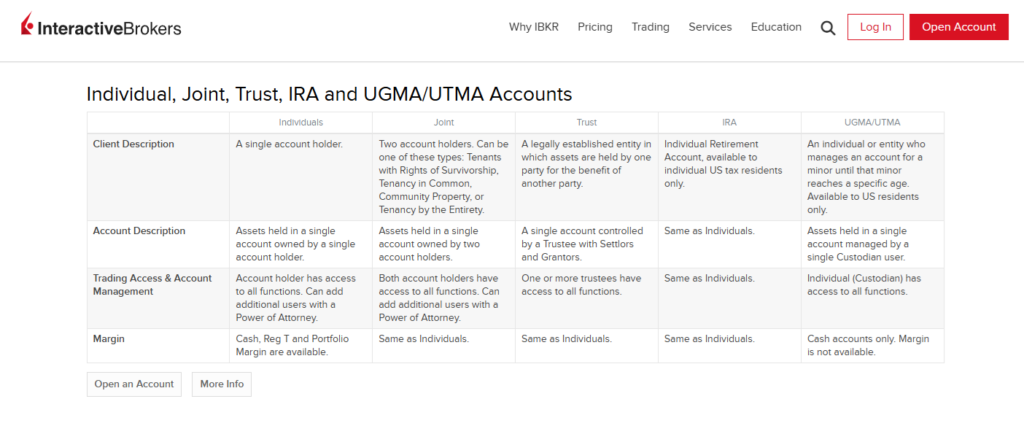

Individual Accounts

- Cash Account: Requires sufficient cash to cover transactions; does not permit borrowing or short selling.

- Margin Account: Allows borrowing to support trading activities, including short selling and options trading.

- Portfolio Margin Account: Offers risk-based margin requirements for qualified investors, potentially providing increased leverage.

Joint Accounts

- Joint Tenants with Rights of Survivorship: Equal ownership; upon death, the survivor inherits the account.

- Tenants in Common: Individual ownership percentages; decedent’s share passes to their estate.

- Community Property: Available in certain states; spouses share equal ownership of assets.

Retirement Accounts (IRAs)

- Traditional IRA: Tax-deferred retirement savings; contributions may be tax-deductible.

- Roth IRA: Contributions made with after-tax dollars; qualified withdrawals are tax-free.

- SEP IRA: Simplified Employee Pension plan for self-employed individuals and small business owners.

- SIMPLE IRA: Savings Incentive Match Plan for Employees; designed for small businesses.

Institutional Accounts

- Proprietary Trading Group Accounts: For organizations trading their own capital; supports multiple users and sub-accounts.

- Hedge and Mutual Fund Accounts: Tailored for fund managers; includes master and sub-account structures.

- Family Office Accounts: Designed for managing family wealth; allows multiple accounts under a single master account.

- Small Business Accounts: For corporations, partnerships, and LLCs; supports multiple users with varying access levels.

Interactive Brokers Customer Reviews

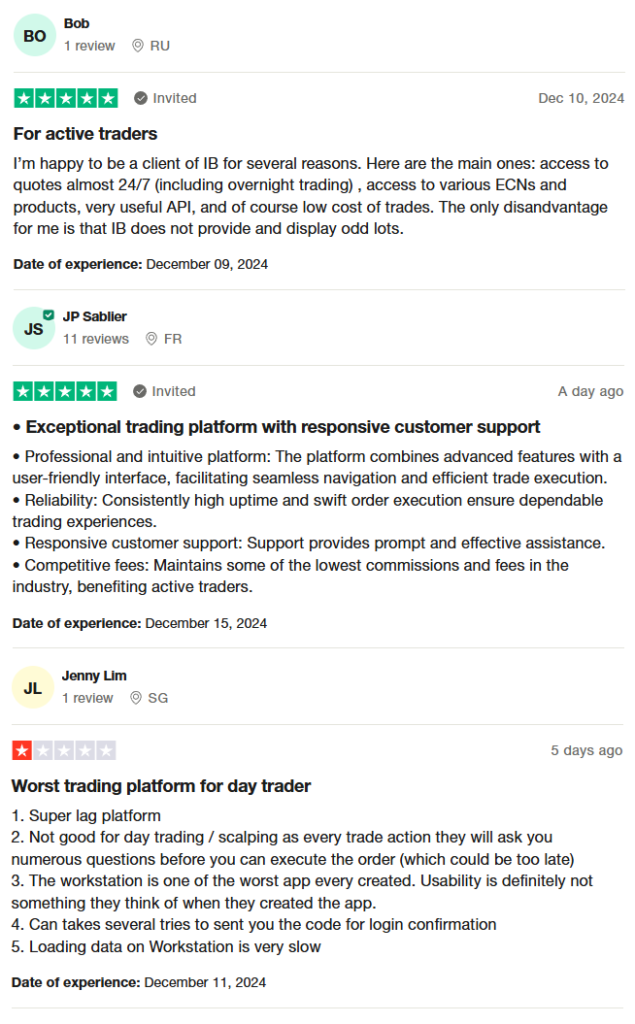

Interactive Brokers receives mixed customer reviews. Many users praise its low trading costs and advanced tools, such as API integration and access to global markets, which benefit professional traders. Customers also appreciate the platform’s reliability with high uptime and efficient trade execution, alongside competitive fees that make it ideal for active traders. However, some users criticize the platform’s usability issues and slow performance, particularly for day trading and scalping, where delays and multiple trade confirmations can hinder execution speed. Additionally, complaints include lagging data load times and occasional difficulties with login verification, impacting the overall user experience.

Interactive Brokers Fees, Spreads, and Commissions

Interactive Brokers offers competitive pricing structures designed to minimize trading costs for investors. Their transparent fee schedules ensure clients are well-informed about potential expenses.

Stock and ETF Trades

For U.S. markets, Interactive Brokers provides a tiered commission structure starting at $0.0035 per share, with rates decreasing as trading volume increases. This model benefits high-volume traders seeking cost efficiency.

Options Trading

Options commissions begin at $0.65 per contract, with reduced rates for higher monthly volumes. Notably, there are no added spreads or platform fees, making it advantageous for active options traders.

Forex Trading

In forex trading, Interactive Brokers offers tight spreads, with some as narrow as 1/10 of a pip, and transparent commissions. This setup appeals to forex traders seeking cost-effective trading conditions.

Interactive Brokers does not impose account minimums or platform fees. However, certain market data subscriptions or inactivity fees may apply, depending on account activity and services utilized.

Our team of trading experts at Trading Insider has found that Interactive Brokers’ cost-effective fee structures and transparent pricing make it a compelling choice for traders aiming to optimize their investment returns.

Interactive Brokers Deposit and Withdrawal

Interactive Brokers offers a variety of deposit methods, including wire transfers, Automated Clearing House (ACH) transfers, and check deposits, providing flexibility for clients worldwide. Our trading professionals at Trading Insider have found that wire transfers are particularly efficient, often resulting in quicker fund availability compared to other methods.

When it comes to withdrawals, Interactive Brokers allows clients to use methods such as ACH transfers, wire transfers, and checks. Notably, clients are entitled to one free withdrawal per calendar month, with subsequent withdrawals incurring fees based on the method and currency.

It’s important to be aware of withdrawal limits, which vary depending on the security device used for two-factor authentication. For instance, accounts without two-factor authentication are limited to $50,000 per day, while those with advanced security devices may have higher or even unlimited withdrawal limits.

Our experts have observed that ACH transfers are convenient for U.S.-based clients, though they may take several business days to process. In contrast, wire transfers can offer faster fund availability but may come with higher fees after the first free monthly withdrawal.

Interactive Brokers maintains a strict policy against accepting physical currency (cash) deposits, emphasizing the use of electronic methods to ensure security and compliance. Clients should utilize wire transfers, ACH, or checks for funding their accounts, as cash deposits are not permitted.

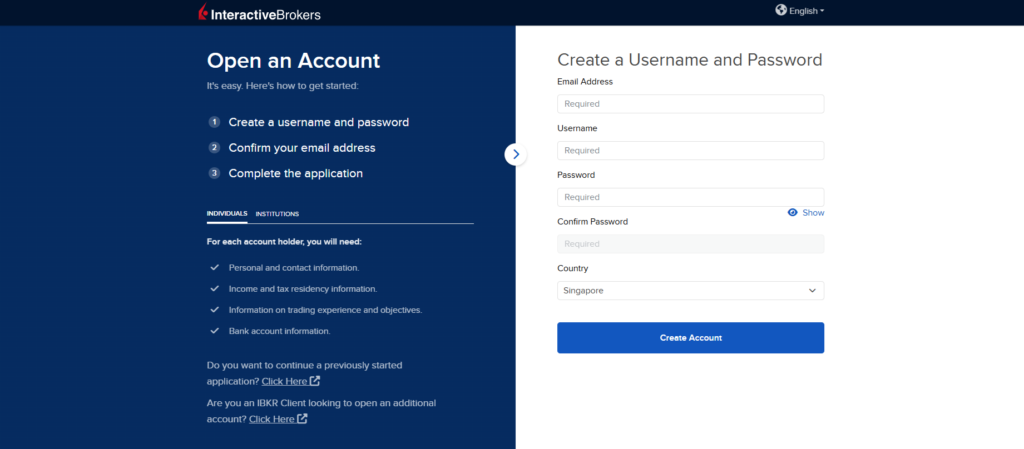

How to Open an Account with Interactive Brokers

1. Go to Interactive Brokers‘ website and click “Open Account.”

2. Create a username and password for your account.

3. Verify your email by clicking the confirmation link sent to you.

4. Choose your account type like Individual, Joint, or IRA.

5. Enter your personal information such as ID, address, and employment details.

6. Upload identification documents like a passport or driver’s license.

7. Fill in your financial information and investment experience.

8. Agree to the terms and conditions after reviewing them carefully.

9. Fund your account using wire transfer, ACH, or other approved methods.

Interactive Brokers Customer Support

Interactive Brokers provides customer support through multiple channels, including phone, email, and live chat. Support is available 24 hours a day during business days, ensuring clients can access assistance across different time zones.

Our team at Trading Insider found that live chat offers prompt responses, making it a convenient option for immediate queries. However, phone support response times can vary, with some users experiencing longer wait times during peak periods.

Interactive Brokers also offers a comprehensive FAQ section and AI-powered IBot, which provide automated assistance for common questions. These resources are useful for clients seeking quick, self-service solutions without contacting support directly.

While the availability of multiple support channels is beneficial, some clients have reported that customer service quality can be inconsistent. Our experts recommend utilizing the self-help resources for general inquiries and reserving direct contact with support staff for more complex issues.

Advantages and Disadvantages of Interactive Brokers Customer Support

Advantages | Disadvantages |

|

|

Interactive Brokers vs. Other Brokers

Interactive Brokers vs. Admirals

Interactive Brokers and Admirals (formerly Admiral Markets) both offer access to a wide range of financial instruments, including forex, stocks, and CFDs. Interactive Brokers provides access to over 150 markets in 33 countries, offering a diverse range of investment options. Admirals offers competitive spreads and a user-friendly platform, making it suitable for traders seeking straightforward access to major markets.

Verdict: Interactive Brokers is better suited for traders seeking extensive global market access and a wide range of investment options. Admirals may be more appropriate for those who prioritize competitive spreads and a user-friendly platform.

Interactive Brokers vs. IG

Both Interactive Brokers and IG offer a comprehensive suite of trading instruments, including forex, stocks, and CFDs. Interactive Brokers provides access to over 150 markets in 33 countries, making it ideal for global investors. On the other hand, IG offers a user-friendly platform and competitive spreads, which attract traders looking for simplicity and efficiency.

Verdict: Interactive Brokers is the better choice for traders seeking global market access and diverse investment options. IG is better for those who value a simple platform and lower trading costs.

Interactive Brokers vs. Alpaca Trading

Interactive Brokers offers a comprehensive suite of instruments, including forex, stocks, and CFDs, with access to over 150 markets globally. In contrast, Alpaca Trading focuses on commission-free stock trading and supports API-driven trading, making it popular among developers and algorithmic traders.

Verdict: Interactive Brokers is ideal for traders looking for global market diversity and advanced tools. Alpaca Trading is better for those who prefer commission-free trades and algorithmic strategies through API integration.

Conclusion: Interactive Brokers Review

Interactive Brokers stands out as a top-tier brokerage for investors and traders seeking global market access and advanced trading tools. With access to over 150 markets in 33 countries, it caters to both seasoned professionals and institutional investors looking for a wide range of financial instruments, including stocks, options, futures, forex, and bonds. The platform’s low commissions and competitive margin rates make it a cost-effective choice for active traders.

However, the platform does come with certain drawbacks. While Trader Workstation (TWS) offers powerful tools and advanced features, it may feel overly complex for beginners and require a steep learning curve. Additionally, some users report inconsistent customer support response times and platform usability issues, particularly for day trading and scalping.

Interactive Brokers Review FAQs

Is Interactive Brokers suitable for beginners?

Interactive Brokers offers advanced tools and access to global markets, which can be overwhelming for beginners. However, with its Client Portal and educational resources, new traders can gradually learn to navigate the platform. Beginners willing to invest time in learning will benefit from its low fees and extensive market options.

Does Interactive Brokers have any hidden fees?

Interactive Brokers is known for its transparent fee structure, but certain charges, like inactivity fees and market data subscriptions, can apply depending on account activity and trading preferences. It’s important to review their pricing page to understand all potential costs.

Can I trade cryptocurrencies on Interactive Brokers?

Yes, Interactive Brokers allows trading of popular cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, through regulated platforms. The service provides competitive rates and ensures a secure trading environment for crypto enthusiasts.