Oil prices rose slightly as traders weighed OPEC+ supply adjustments and potential economic support measures from China. Brent crude climbed to $80.56 a barrel, while WTI futures settled at $75.12, reflecting a market tightly balanced between supply constraints and uncertain demand outlooks. Expectations for China’s economic stimulus measures have offered some optimism, though analysts remain cautious about their potential impact on global oil demand.

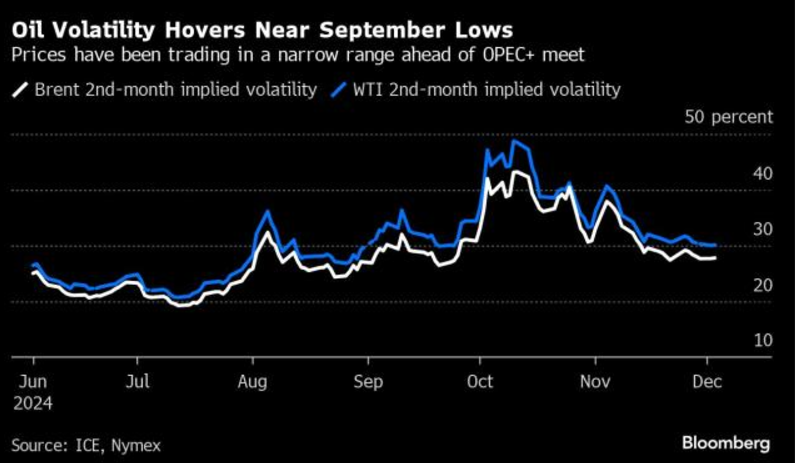

OPEC+ has maintained its commitment to cutting production, signaling potential extensions of current curbs into 2024. These moves aim to stabilize the market amid mixed demand signals, especially from major economies. However, concerns over U.S. stockpiles and geopolitical tensions continue to inject volatility into the market.

While the focus remains on China’s economic activity, analysts suggest sustained price recovery depends on broader demand improvements. The market is expected to stay sensitive to OPEC+ actions and macroeconomic data in the weeks ahead.