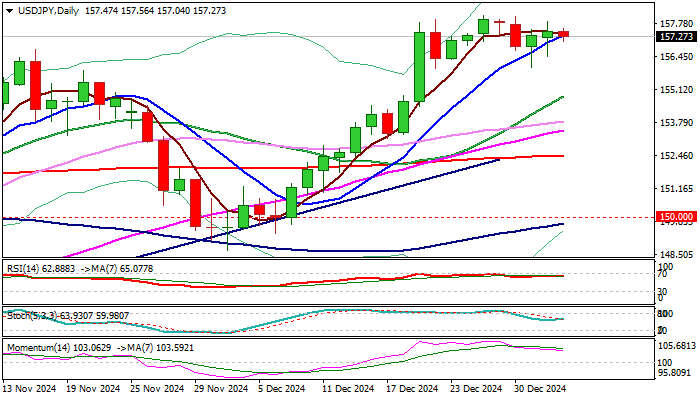

The USD/JPY pair continued its upward trajectory as investors bet on the divergence between the Federal Reserve’s hawkish stance and the Bank of Japan’s dovish policies. The pair recently breached multi-month highs, fueled by robust U.S. economic data and a resilient dollar. Speculation is growing over the BoJ’s potential intervention, with officials signaling their readiness to act should the yen weaken excessively.

Source – FXStreet

Market analysts suggest that the yen’s depreciation aligns with Japan’s ultra-loose monetary policy, which contrasts sharply with tightening measures in the U.S. However, traders remain cautious as Japan’s Ministry of Finance has previously intervened when USD/JPY crosses critical levels. The prospect of intervention may temper excessive speculative positioning, leaving markets on edge for further developments.