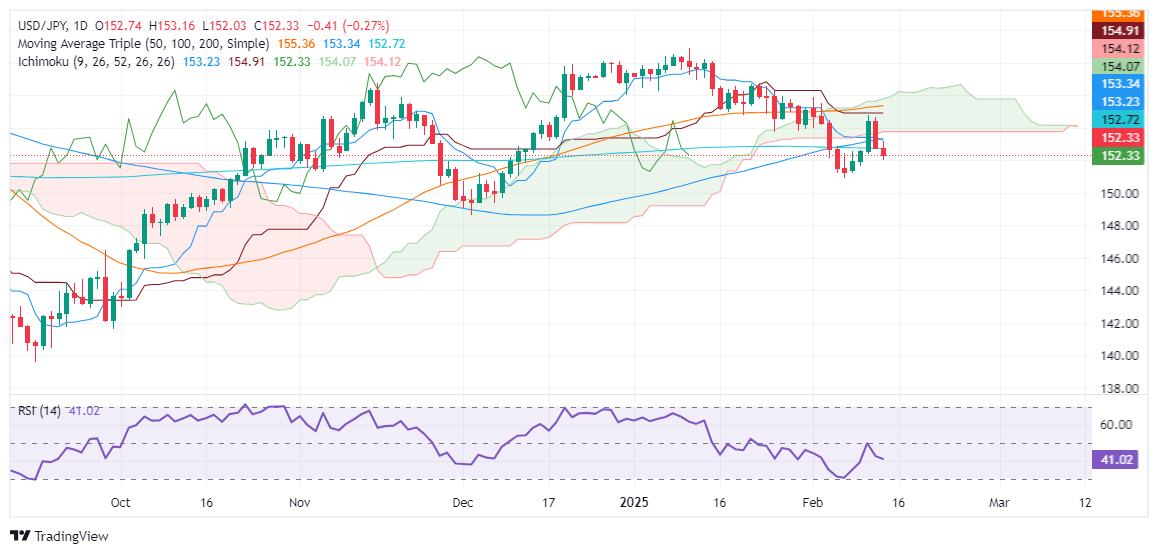

The US dollar (USD) extended its decline against the Japanese yen (JPY), with USD/JPY breaking below its 200-day simple moving average (SMA), a key technical level closely watched by traders. The move reflects growing downside pressure on the dollar as markets reassess the Federal Reserve’s policy outlook and shifting risk sentiment.

The dollar’s slide comes as US economic data continues to show signs of softening, raising speculation that the Fed may take a less aggressive approach on interest rates in the coming months. This has weighed on Treasury yields, reducing the greenback’s appeal and allowing the yen to strengthen despite ongoing policy divergence with the Bank of Japan (BoJ).

USD/JPY 1-D Chart as of February 14th, 2025 (Source: TradingView)

Meanwhile, the yen has gained support amid rising expectations that the BoJ could move toward policy normalization. While Japan’s central bank has been slower to tighten monetary policy than its global peers, recent signals suggest a potential shift, fueling demand for the yen and adding to USD/JPY’s downside momentum.

The break below the 200-day SMA is seen as a significant bearish signal, with technical analysts eyeing further declines if USD/JPY fails to reclaim key resistance levels. If the pair remains below this threshold, selling pressure could intensify, opening the door for a deeper correction.

Broader risk sentiment also plays a role, with global investors adjusting positions amid uncertainty over US trade policies, inflation trends, and geopolitical risks. The yen’s traditional role as a safe-haven asset has further strengthened its position, particularly as concerns over global growth persist.

Looking ahead, traders are watching upcoming US economic reports and Federal Reserve commentary for further direction. If the Fed reinforces expectations of a pause or rate cuts, USD/JPY may continue its downward trajectory, while any signs of resilience in the US economy could trigger a rebound.

For now, USD/JPY remains under pressure, with the dollar’s weakness and the BoJ’s evolving policy stance shaping the pair’s next move in global currency markets.