The U.S. dollar remains firm against the Canadian dollar, with USD/CAD hovering around 1.4350 as investors await key insights from the Federal Reserve’s latest meeting minutes. Traders are closely watching for any signals on future interest rate moves, which could determine the next direction for the pair.

A hawkish tone from the Fed could reinforce expectations of prolonged higher rates, keeping the dollar supported and limiting the loonie’s recovery. Recent U.S. economic data has pointed to resilience in both the labor market and inflation, reducing the likelihood of an imminent rate cut. This has helped maintain the greenback’s strength, while risk-sensitive currencies like the Canadian dollar struggle for momentum.

Meanwhile, Canada’s economic outlook remains mixed. While oil prices, a key driver for the loonie, have seen some support, concerns over slowing growth and a potential easing stance from the Bank of Canada have kept CAD under pressure. Markets expect the BoC to take a more dovish approach than the Fed, creating further divergence between the two currencies.

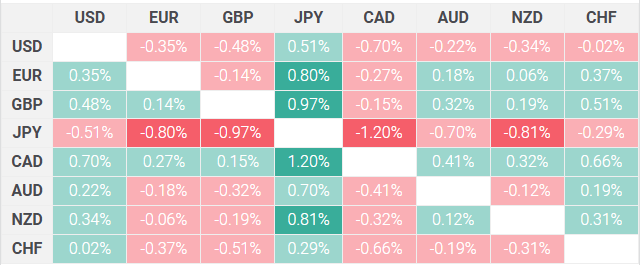

US Dollar Price Against Major Currencies as of January 8, 2025 (Source:FXStreet)

Risk sentiment also plays a crucial role, with global uncertainty adding to the dollar’s safe-haven appeal. Investors remain cautious amid geopolitical tensions and fluctuating commodity prices, factors that could keep the USD/CAD pair elevated in the near term.

Looking ahead, the FOMC minutes will likely set the tone for upcoming moves. A stronger-than-expected hawkish stance could push USD/CAD higher, while any sign of a shift toward easing could trigger a pullback. Until then, the pair remains steady, with traders awaiting clarity from the Fed’s policy outlook.