The US Dollar held firm at the start of the week, maintaining its recent strength as traders positioned themselves for a series of pivotal speeches by Federal Reserve officials. Investors are waiting for clues on the central bank’s next moves, particularly regarding interest rates, which could determine the dollar’s trajectory in the near term.

Market participants remain cautious, with the dollar index, which measures the greenback against major currencies, staying close to recent highs. Expectations are mounting that the Federal Reserve may keep interest rates elevated longer than previously anticipated, offering continued support for the dollar.

Attention is focused on Fed Chair Jerome Powell’s upcoming remarks, where any signals on inflation or the economic outlook could shape investor sentiment. Analysts warn that any departure from the Fed’s hawkish tone could trigger volatility in the dollar’s position.

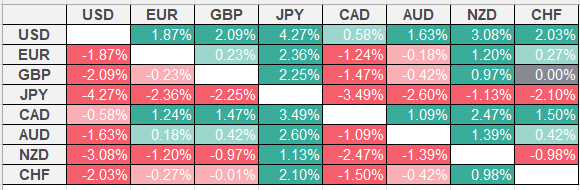

Meanwhile, the broader forex market saw limited movement, with the euro and yen showing little change as traders adopted a wait-and-see approach. The European Central Bank is also in the spotlight, with increasing speculation about potential policy shifts after the latest economic data releases.

For now, currency markets are in a holding pattern, with investors keeping a close watch on how central banks address inflationary pressures in the coming days.