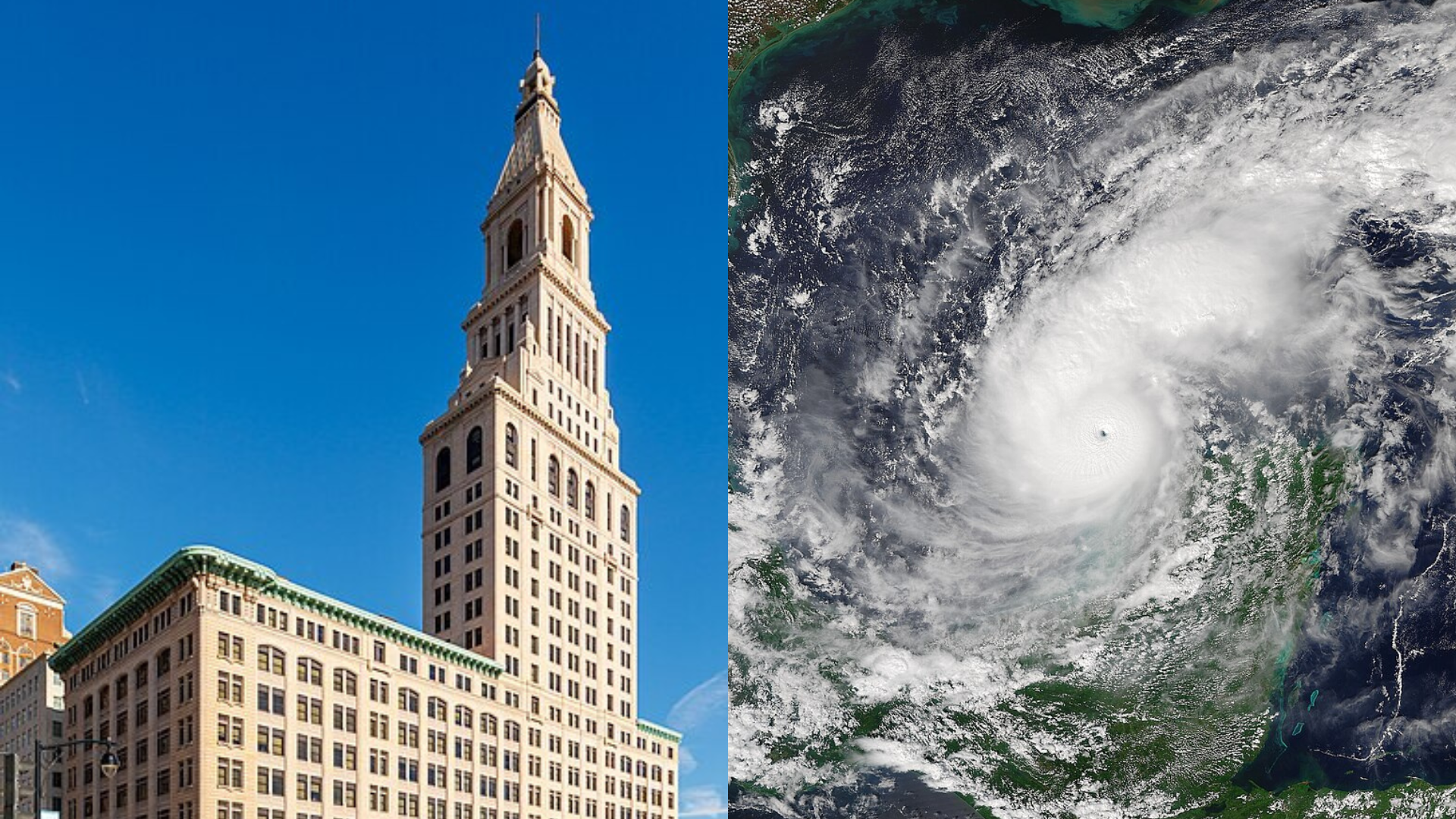

Shares of Travelers Companies went down as investors got ready for what Hurricane Milton, which looks like it will be like Hurricane Helene, might do. Travelers is one of the biggest property and casualty insurers in the U.S., and the thought of two storms in a row has made the company worried about the big claims it could face. The insurance giant’s stock was already under pressure after Helene caused damage, and the threat of Milton is making investors even more nervous.

Natural disasters like storms can cost insurers a lot of money because they have to pay for a lot of property damage and injury claims. Analysts say that if Hurricane Milton hits densely populated places, it could make costs even higher for Travelers, which would hurt the stock price even more. The company is known for being strong, but it might have a rough quarter as it deals with the effects of both of these terrible weather events.

People who invest in stocks are paying close attention to where Hurricane Milton is going because it could determine how much damage is done. If Milton hits land in important places, Travelers’ stock price could drop even more, showing how much money the company expects to lose. If the storm gets weaker or changes direction, on the other hand, the stock may get some relief, but for now, the market is still being careful.

Aside from the current weather concerns, Travelers’ stock performance could also be affected by how well the insurance industry handles natural disasters that are happening more often and with more force. Because of climate change, weather trends are becoming less predictable and more severe. This means that insurers like Travelers have to pay more to cover claims and figure out how to price premiums to reflect these higher risks. Some experts say that companies in the sector could have trouble making money in the long term if they don’t change their models or strategies.Even with these risks, Travelers has a lot of cash on hand, which could help it handle the effects of several storms in a row. The insurance company has shown in the past that it can handle natural disasters by using diversified portfolios and reinsurance methods to keep losses to a minimum. Investors are still worried about the short-term effects that Hurricane Milton could have on the economy, especially if it hits areas that have already been hit hard.