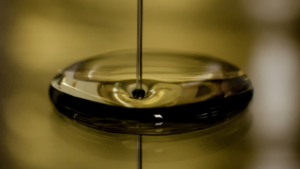

As the ruble continues to face significant pressure from high inflation and Western sanctions, Russians are increasingly turning to gold as a safe-haven asset. The surge in gold purchases reflects growing concerns over the currency’s stability amid persistent economic headwinds. With the ruble’s value eroding, both individuals and institutions are seeking refuge in tangible assets to preserve their wealth.

The demand for gold has accelerated as inflation remains elevated, eroding the purchasing power of the local currency. Sanctions imposed due to geopolitical tensions have further strained Russia’s economy, limiting access to foreign markets and financial systems. This combination has driven a shift in investment behavior, with gold viewed as a more reliable store of value compared to volatile fiat currencies.

Financial institutions have reported a noticeable spike in gold transactions, with some banks expanding their precious metals offerings to meet the rising demand. Retail investors are also buying gold bars and coins, reflecting widespread anxiety about the ruble’s long-term prospects. Analysts note that this trend mirrors historical patterns, where gold becomes a preferred asset during times of economic uncertainty and currency devaluation.

The Russian government’s stance on gold has also influenced this shift, as authorities promote the metal as part of broader efforts to reduce reliance on Western financial systems. By encouraging gold accumulation, Russia aims to strengthen its economic resilience in the face of ongoing sanctions. This strategy aligns with the central bank’s previous moves to increase gold reserves as a buffer against external shocks.

However, the rush to gold also highlights underlying vulnerabilities in Russia’s economic landscape. While it provides short-term protection for investors, it does little to address structural issues such as declining foreign investment, supply chain disruptions, and reduced access to global financial networks. The reliance on gold underscores the challenges Russia faces in stabilizing its economy amid prolonged geopolitical and economic pressures.

As global markets react to these developments, the sustained demand for gold in Russia could impact international precious metals markets. Traders will be closely monitoring Russia’s economic indicators and currency movements, as shifts in the ruble’s value and inflation trends will likely continue to drive demand for safe-haven assets