The global oil market is expected to be in surplus, even as OPEC+ takes action to balance supply and demand. Analysts suggest that the group’s production cuts may not be sufficient to offset the rising output from non-OPEC producers.

Despite OPEC+’s efforts to stabilize prices, increased production from countries like the United States and Brazil is contributing to the surplus. This oversupply situation is putting downward pressure on oil prices, challenging the effectiveness of OPEC+’s strategy.

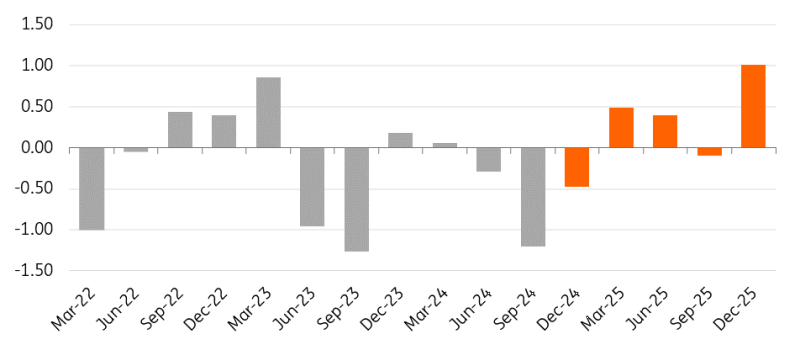

Source – FXStreet

Market observers are closely watching how OPEC+ will respond to these developments. The group’s ability to influence global oil prices is being tested, as they navigate the complexities of a market with diverse and dynamic supply sources.

As the oil market remains in flux, the focus will be on upcoming OPEC+ meetings and potential adjustments to their production targets. The surplus highlights the ongoing struggle to achieve a balanced and stable oil market.