Pressure is mounting within OPEC+ as the global oil market grapples with shifting demand dynamics and economic uncertainty. The coalition of oil-producing nations, led by Saudi Arabia and Russia, has been striving to balance production cuts with rising global inflation and fluctuating energy demands. However, with oil prices hovering at volatile levels, cracks are beginning to appear in the alliance as members voice concerns over market strategy.

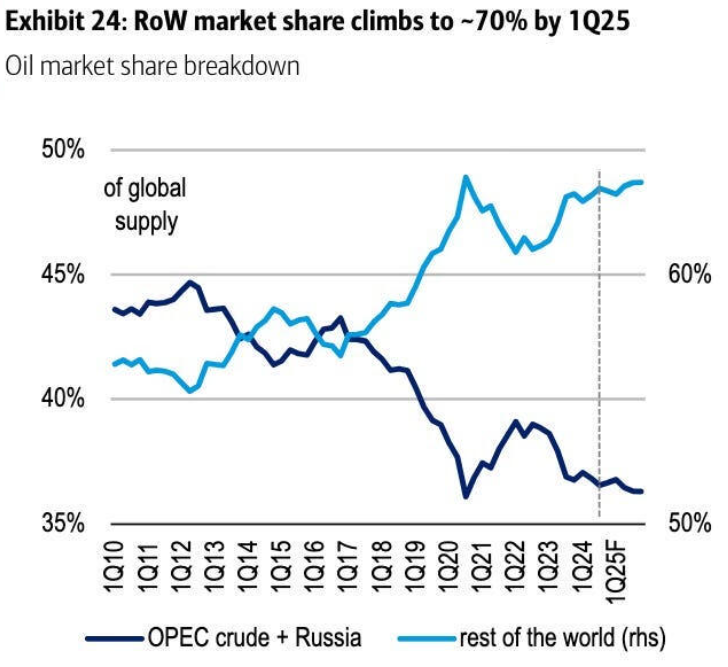

Source:IEA, BofA Global Research estimates

Despite the group’s efforts to stabilize prices, internal differences are becoming more apparent. Some OPEC+ members, notably those with higher production capacities, are growing increasingly frustrated with the extended production cuts that have limited their output potential. As energy demand remains inconsistent, these nations are questioning the long-term effectiveness of curbing supply in the face of global economic pressures.

The situation is further complicated by external factors such as global economic slowdowns and the fluctuating strength of the U.S. dollar, which directly impacts oil prices. With countries like the United States boosting their energy output, OPEC+ faces increasing pressure to maintain cohesion while responding to market demands. Analysts suggest that any significant shift in strategy could lead to further fragmentation within the group, which may destabilize the oil market.

As OPEC+ approaches its next meeting, the path forward remains uncertain. Members are expected to weigh the balance between market control and economic growth, with the potential for internal disputes to shape the group’s future actions. A failure to align could have lasting consequences, not only for the oil market but also for global energy stability.