In trading, the allure of following prevailing trends—buying in bullish and selling in bearish phases—is strong. However, seasoned traders often find that unconventional strategies, like contrarian trading, which opposes dominant market sentiments, can unlock significant opportunities. This approach isn’t about opposing the crowd for opposition’s sake but rather about pinpointing moments when the majority may be off the mark.

Contrarian strategies gain effectiveness when combined with thorough technical and fundamental analyses. This comprehensive approach helps traders understand underlying market dynamics that simple trend following might miss.

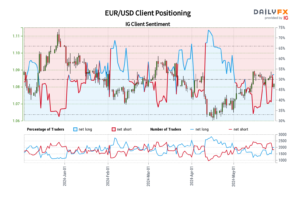

EUR/USD Outlook

Source: dailyfx.com

IG client sentiment indicates that 50.87% of traders are bullish on EUR/USD, with a long-to-short ratio of 1.04 to 1. There’s been a 23.99% increase in buyers since yesterday and a 13.24% rise over the last week, while short positions have decreased by 15.17% and 10.11%, respectively.

Our contrarian perspective suggests that the net-long sentiment could indicate a potential decline for EUR/USD, enhancing our bearish outlook.

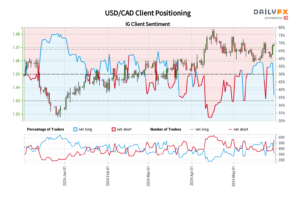

USD/CAD Outlook

Source: dailyfx.com

66% of traders are bearish on USD/CAD, with shorts outnumbering longs at a ratio of 2.27 to 1. The count of sellers has surged by 47.98% since the last session and 44.21% over the week, while long positions have dropped 43.62% from yesterday and 29.56% from last week.

This strong bearish sentiment among traders suggests a potential upside, aligning with our bullish contrarian stance.

Dow Jones 30 Outlook

Source: dailyfx.com

54.25% of traders are optimistic about the Dow Jones 30, with a long-to-short ratio of 1.19 to 1. Long positions have increased by 24.50% since yesterday and a remarkable 107.54% over the past week.

Short positions, however, have decreased by 12.87% and 29.52%, respectively. This bullish sentiment among traders could imply upcoming market weakness, supporting our bearish contrarian view.