As January approaches, financial analysts are closely monitoring the convergence of long-term market cycles with critical price targets, signaling potential shifts in economic conditions. Since the 2009 conclusion of the global financial crisis, the bull market has persisted, with only brief interruptions, such as the early 2020 downturn. Notably, many investors under 35 have yet to experience a significant bear market.

Source – FXStreet

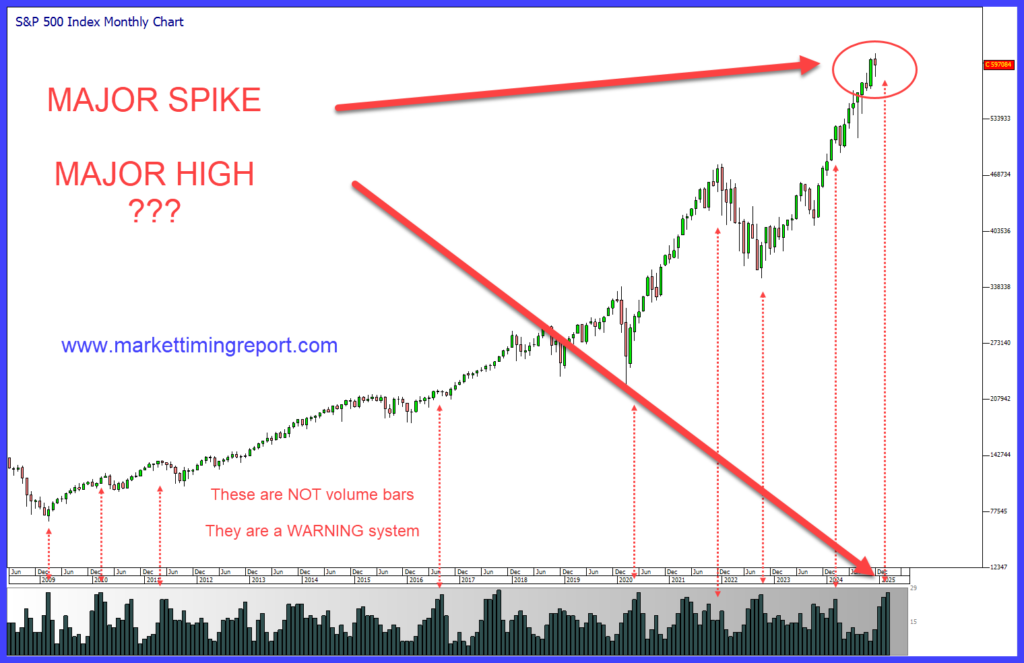

Recent analyses highlight a substantial monthly cycle spike in U.S. markets, particularly within the S&P 500 index. Historically, these spikes have preceded notable market turning points, offering predictive insights into potential trend changes.

While this alignment doesn’t guarantee a market downturn, it serves as a cautionary indicator. Analysts advise vigilance, suggesting that investors prepare for possible market fluctuations and consider strategies to mitigate risks associated with these cyclical patterns.