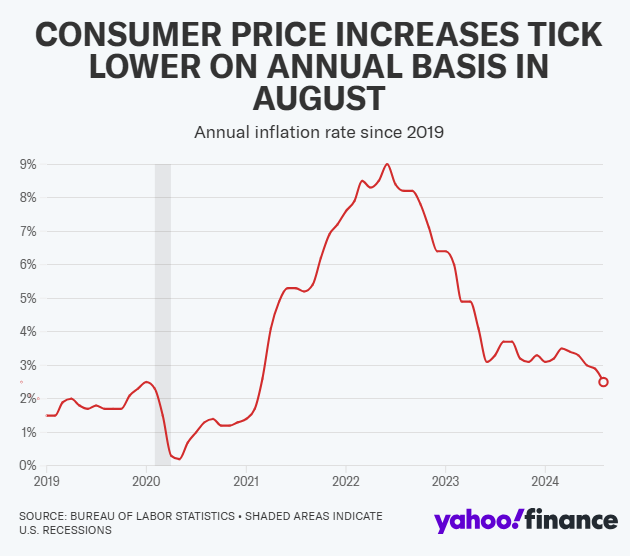

All eyes are on the upcoming September Consumer Price Index (CPI) report, which will serve as a crucial indicator of whether inflation is continuing to ease as the Federal Reserve navigates its next interest rate decision. The report, due Thursday morning, is expected to show a further moderation in inflation, with headline inflation forecasted to rise 2.3% year-over-year, down from August’s 2.5%. On a monthly basis, prices are expected to have increased just 0.1%, slightly less than the prior month’s 0.2% gain.

While inflation has steadily cooled from its pandemic-era highs, it remains above the Fed’s 2% target, particularly on a core basis, which excludes volatile food and energy prices. Economists expect core inflation to remain sticky at 3.2%, unchanged from August’s figure, with monthly core price growth forecast to slow slightly to 0.2% from August’s 0.3%.

Despite the signs of moderating inflation, “upside risks” persist, which could complicate the Fed’s path forward. Factors such as rising oil prices, higher shipping costs, and sticky inflation in rent and services could trigger a hotter-than-expected reading. These risks, combined with ongoing labor market strength, may lead to a more gradual disinflationary process than markets currently anticipate.

The Federal Reserve is carefully balancing inflation concerns with a surprisingly resilient labor market, which continues to outperform expectations. Data from the Bureau of Labor Statistics last Friday showed the U.S. economy added 254,000 jobs in September, significantly higher than the 150,000 forecasted. The unemployment rate also edged lower to 4.1%. This robust report has shifted expectations about the Fed’s next rate cut, with markets now pricing in a 25 basis point cut in November, down from prior hopes of another 50 basis point reduction.

As inflation cools but remains elevated, Fed officials have increasingly turned their attention to the labor market, which has so far shrugged off the impact of high interest rates. Citi economist Veronica Clark noted that the bar for the Fed to refrain from cutting rates in November is high. “We still expect a smaller 25bp cut in November, followed by a 50bp cut in December as inflation continues to moderate and labor market trends weaken,” Clark said.

The market’s focus on inflation is heightened following last week’s strong jobs report. Bank of America equity strategist Ohsung Kwon warned that while stocks may handle a slight upside surprise in inflation, a larger-than-expected CPI print could introduce uncertainty and volatility into markets, potentially complicating the Fed’s easing cycle.

The September CPI data will be closely watched for signals of persistent inflation in key categories such as shelter costs, medical services, and used car prices. Citi economists see potential risks of stronger inflation in owners’ equivalent rent, which tracks the hypothetical rent homeowners would pay for their homes. Bank of America analysts also pointed to rising airfares and lodging costs as possible contributors to firmer core inflation in September.

While most forecasts still point toward disinflation in the months ahead, the outcome of Thursday’s CPI report could play a pivotal role in shaping both market sentiment and the Fed’s policy direction for the rest of the year. With the Fed’s data-driven approach in full swing, any surprises in the inflation data could dramatically alter the central bank’s rate trajectory heading into 2024.