Gold prices remained in an upward trend this week, supported by safe-haven demand and expectations of a more cautious Federal Reserve. However, the metal faces the possibility of a near-term technical correction as traders take profits and reassess economic data.

The Federal Reserve’s policy stance continues to be a key driver for gold, with investors closely monitoring inflation trends and interest rate expectations. Softer economic indicators could reinforce bets on a dovish Fed, further supporting gold’s appeal. Conversely, any hawkish signals may trigger short-term selling pressure.

Geopolitical tensions and fluctuations in the U.S. dollar have also played a role in keeping gold elevated. While a weaker dollar typically benefits the metal, any renewed strength in the greenback could weigh on prices and limit gains.

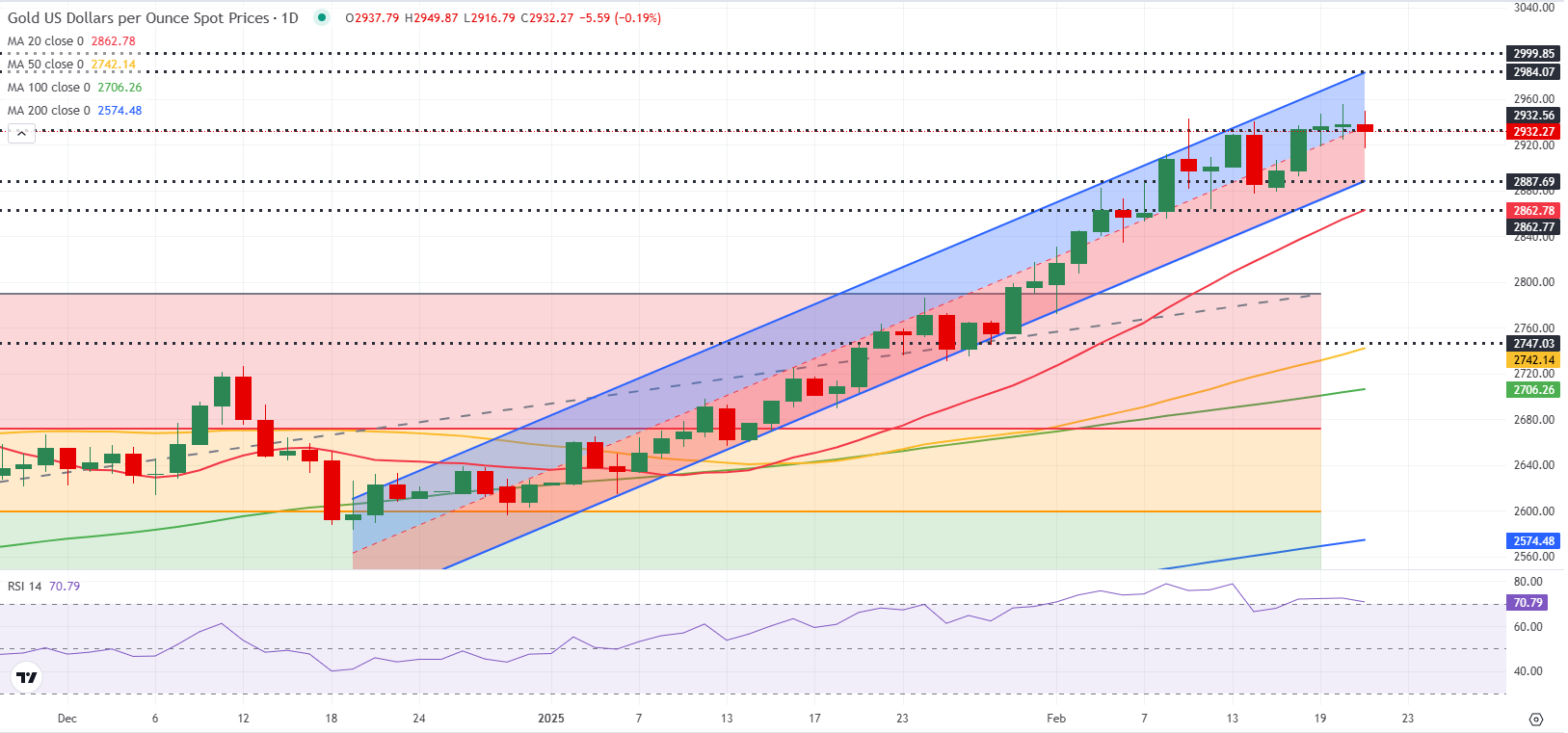

Gold US Dollars Chart as of February 24, 2025 (Source: TradingView)

Market participants are eyeing key technical levels, with strong resistance near recent highs and support zones indicating potential pullbacks. A sustained break above current levels could fuel further buying, while a failure to hold support might accelerate a corrective move.

Looking ahead, traders will focus on upcoming economic releases and central bank commentary, which could provide fresh direction for gold. As uncertainty persists, market volatility may offer both risks and opportunities for bullion investors.

Additionally, rising bond yields and shifting risk sentiment could influence gold’s trajectory in the coming weeks. If yields continue to climb, the opportunity cost of holding gold may increase, prompting some investors to rotate into interest-bearing assets.