The British pound held firm above 1.2650 on Wednesday, hovering near a two-month high as traders assessed the outlook for UK economic data and the Federal Reserve’s next moves. The currency pair has benefited from a weaker US dollar, while investor sentiment around the Bank of England’s (BoE) policy stance continues to shape market expectations.

A softer US dollar has provided support for the pound, as markets remain uncertain about the Fed’s rate-cut timeline. While some policymakers have signaled caution, recent economic data has suggested a gradual cooling in inflation, keeping traders on edge about the possibility of monetary easing later this year. This has limited dollar strength, allowing GBP/USD to maintain its gains.

Domestically, the UK economy has shown resilience, with recent reports indicating steady labor market conditions and stable growth. While inflation remains a concern, expectations that the BoE may hold rates higher for longer have provided some underlying support for the pound. However, any signals of slowing economic momentum could weigh on sentiment, making upcoming data releases key for market direction.

At the same time, broader risk sentiment is playing a role in GBP/USD’s movement. With global investors keeping a close watch on geopolitical developments and trade policy shifts, the pound has remained relatively stable, benefiting from improved investor confidence in risk-sensitive assets.

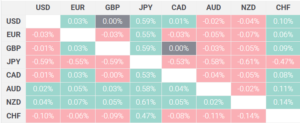

GBP/USD Price Against Major Currencies as of February 21, 2025 (Source: FXStreet)

Technical indicators suggest that GBP/USD faces resistance near the 1.2700 level, with a breakout above this mark potentially opening the door for further gains. On the downside, a break below 1.2650 could trigger profit-taking, bringing key support levels into focus.

For now, the pound remains well-positioned, but traders are closely monitoring macroeconomic signals for further clues on policy direction. With both the BoE and the Fed expected to play a key role in shaping market sentiment, the next few sessions could determine whether GBP/USD extends its rally or faces renewed selling pressure.