The US dollar remains steady, consolidating recent gains as investors await critical economic data and the release of the FOMC minutes. Traders are positioning cautiously, with the Federal Reserve’s outlook on interest rates expected to drive sentiment in the coming sessions.

Stronger-than-expected US labor market data and persistent inflation concerns have reinforced expectations that the Fed will keep rates higher for longer. This has supported the dollar, with investors scaling back bets on early rate cuts. Meanwhile, Treasury yields remain elevated, further bolstering demand for the greenback.

Major currency pairs have struggled for clear direction, with the euro and British pound trading in tight ranges. The euro remains under pressure as weak economic indicators out of the eurozone raise concerns over growth, while the pound faces similar headwinds amid mixed signals from the Bank of England.

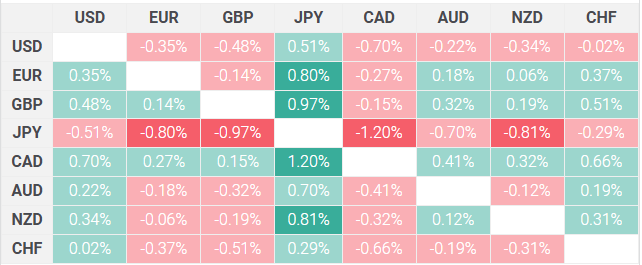

US Dollar Price Against Major as of January 8, 2025 (Source:FXStreet)

Risk-sensitive currencies, including the Australian dollar, have also faced challenges as broader market sentiment remains cautious. The outlook for global monetary policy remains a key factor, with central banks across major economies weighing inflation risks against slowing growth.

Markets are closely watching the upcoming US retail sales report and inflation readings, which could provide further clarity on the Fed’s trajectory. A stronger set of data could reinforce the dollar’s strength, while any signs of softening inflation may revive expectations for rate cuts later this year.

Until then, currency markets remain in a wait-and-see mode, with traders hesitant to take strong positions ahead of key macroeconomic releases. The FOMC minutes will be critical in shaping near-term market direction, determining whether the dollar’s recent resilience can be sustained.