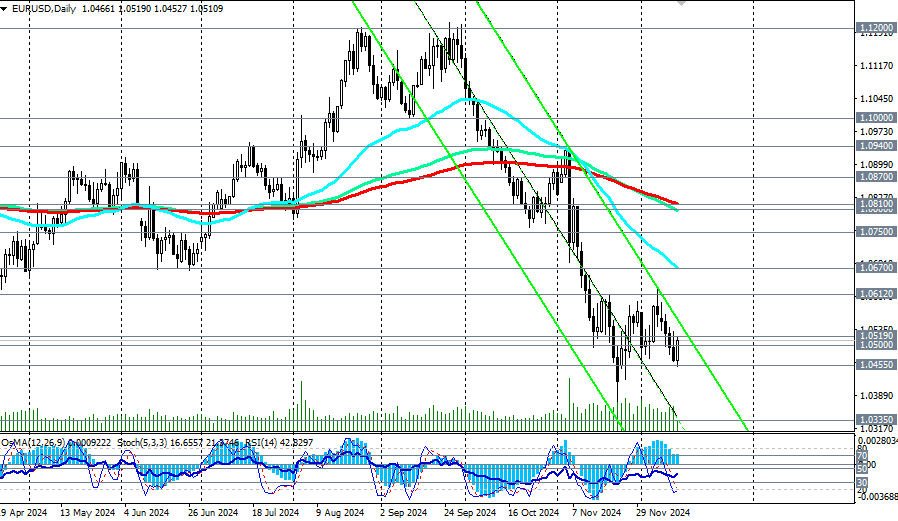

The EUR/USD pair has faced renewed pressure as the US dollar continues to gain ground, driven by robust economic data and hawkish signals from the Federal Reserve. The euro struggled to hold key support levels, reflecting weaker sentiment around the eurozone’s economic recovery and ongoing concerns over subdued growth. Meanwhile, the dollar’s appeal has been bolstered by rising Treasury yields and expectations of further rate hikes.

Source – FXStreet

Market participants remain cautious ahead of key US economic releases, including retail sales and industrial production data, which could further influence the greenback’s trajectory. The eurozone’s sluggish inflation outlook and lack of fresh policy action from the European Central Bank have added to the euro’s woes. Analysts suggest the EUR/USD pair could face additional downside risks if current trends persist, with the next significant support level eyed near 1.0500.

Investors will closely monitor Fed Chair Jerome Powell’s upcoming remarks for any indications of a shift in monetary policy. For now, the EUR/USD outlook remains firmly tilted to the downside, underscoring the persistent divergence in economic momentum between the US and the eurozone.