The euro weakened against the Japanese yen, with EUR/JPY retreating to multi-day lows as demand for the yen picked up. Investors sought safety in the Japanese currency, benefiting from shifting risk sentiment and speculation about potential changes in Bank of Japan policy.

Despite the yen’s prolonged weakness in recent months, signs of resilience have emerged as global markets reassess monetary policy outlooks. Traders are closely watching the BoJ, as officials have hinted at the possibility of adjustments to Japan’s ultra-loose monetary stance. This has given the yen some strength, particularly against the euro, which has struggled amid mixed economic data from the eurozone.

The European Central Bank remains cautious about rate cuts, but economic uncertainties and signs of slowing inflation have kept pressure on the euro. Meanwhile, broader market sentiment has also fueled the yen’s recovery, with geopolitical tensions and global economic concerns prompting a move toward safer assets.

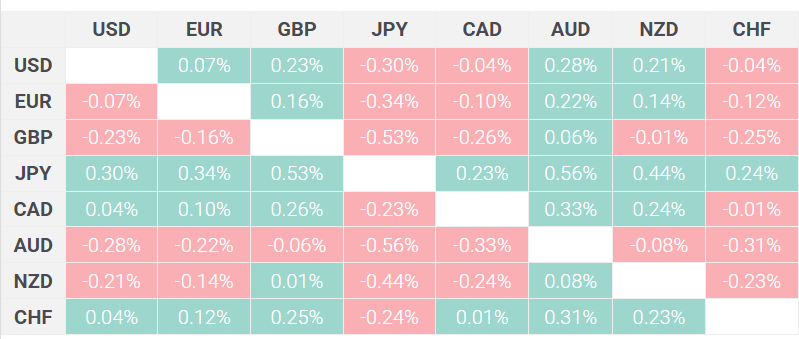

US Dollar Price Against Major Currencies as of January 9th, 2025 (Source: FXStreet)

As long as speculation around BoJ policy shifts persists, the yen may continue to see bouts of strength, keeping EUR/JPY under pressure. However, the euro could regain momentum if ECB officials signal a firmer stance on inflation or if risk sentiment improves globally.

For now, investors remain cautious, awaiting clearer signals from central banks. EUR/JPY’s direction will depend on upcoming economic releases and how policymakers navigate diverging monetary paths. If risk aversion remains in play, the yen’s gains could extend further in the near term.