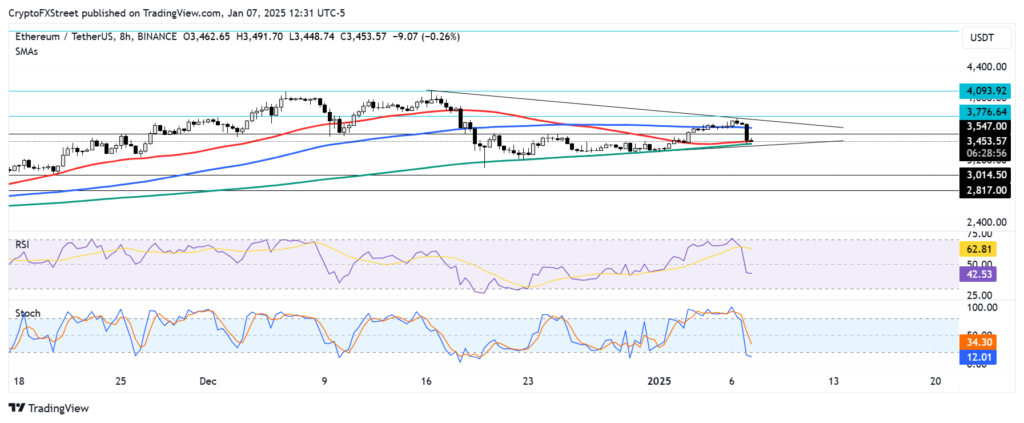

Ethereum (ETH) experienced a sharp decline of over 6% in recent trading, marking one of its steepest single-day losses in recent weeks. The drop coincides with a surge in staking withdrawals, raising concerns about investor confidence in the cryptocurrency’s staking ecosystem. The sell-off has led to increased volatility, with ETH now trading well below key psychological levels, signaling potential further downside.

Source – FXStreet

The rise in withdrawals comes as staking rewards remain under scrutiny amid a broader market pullback. Data indicates that a significant number of long-term stakers opted to withdraw their holdings following the unlocking of staking mechanisms. Analysts point to these withdrawals as a major catalyst for the downward pressure on ETH, as liquidated assets often re-enter the market, further increasing selling activity.

While some investors view the withdrawals as a routine shift in portfolio management, others interpret it as a signal of waning confidence in Ethereum’s staking appeal. Critics argue that the unlocking feature could introduce long-term instability by allowing capital to leave the ecosystem. Despite these challenges, proponents remain optimistic about Ethereum’s fundamentals, emphasizing its continued dominance in decentralized finance (DeFi).