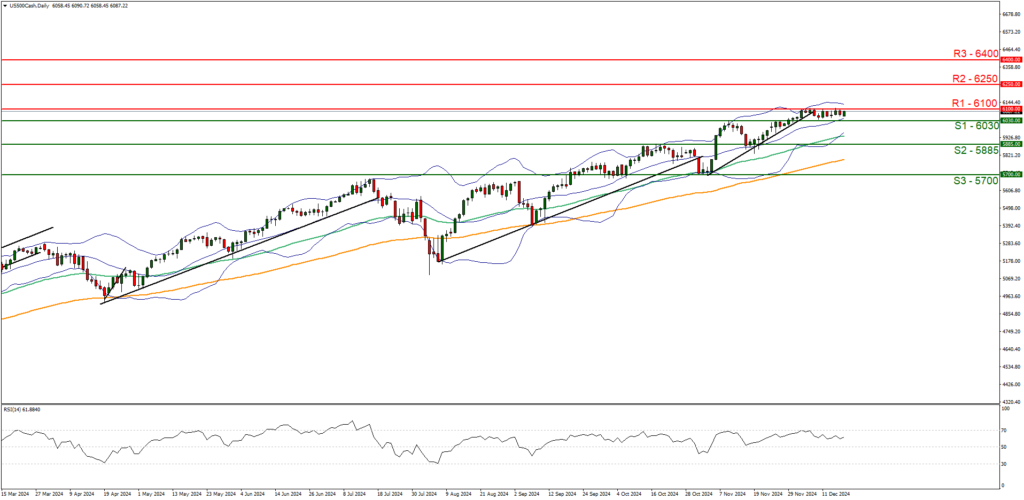

U.S. equities are set to close out 2024 with heightened volatility as markets await key signals from the Federal Reserve’s final policy meeting and November inflation data. Investors remain on edge, with expectations split between a possible rate hold or a surprise hike, as inflation pressures persist despite slowing economic growth.

Source – FXStreet

Fed Chair Jerome Powell has emphasized the central bank’s data-driven approach, signaling that inflation trends and labor market resilience will heavily influence the December decision. Meanwhile, the latest Consumer Price Index (CPI) report, due ahead of the Fed meeting, is expected to show a slight moderation in core inflation, though price levels remain above the 2% target. A hawkish stance from the Fed could pressure equities, while a more dovish tone may provide relief to sectors battered by tightening financial conditions.

Market participants are bracing for significant movement across sectors, particularly in tech and consumer discretionary, which have been sensitive to rate policy shifts. The interplay between inflation data and Fed policy will likely define investor strategies heading into 2025, as concerns over a potential recession loom large.