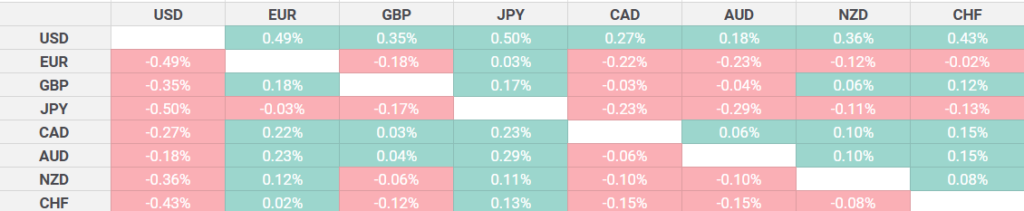

The EUR/USD pair continued to decline on Monday, falling below the 1.0550 mark as traders waited for important updates, including European Central Bank (ECB) President Christine Lagarde’s speech and US PMI data. The Euro struggled, weighed down by a stronger US Dollar and rising concerns about global economic uncertainty.

Before Lagarde’s speech, markets were focusing on how the ECB might handle slowing growth and lower inflation trends. Recent comments from ECB policymaker Martins Kazaks, who supports cutting rates further, added to expectations of a shift. This contrasts with the Federal Reserve’s hawkish stance, as strong US economic reports suggest the Fed may keep interest rates high.

Traders are also paying attention to the upcoming US PMI data, which could provide clues about the health of the US economy. If the data is strong, it could boost the US Dollar’s strength and widen the gap between the ECB and the Federal Reserve’s policies. On the other hand, weaker data may allow the Euro some relief, but market sentiment remains cautious.

Given the US economy’s resilience, Forex traders are hesitant to push the Euro higher. The Dollar’s strength continues to weigh on the EUR/USD pair, highlighting concerns about the Eurozone’s economic challenges and the ECB’s ability to handle inflation and growth simultaneously.

Looking ahead, Lagarde’s speech and US PMI data will play a big role in deciding the direction of the EUR/USD pair. For now, the Euro will likely stay in a narrow trading range as the US Dollar’s momentum keeps the pair under pressure.