A Bank of Japan (BoJ) official stated on Tuesday that underlying inflation in Japan is gradually moving toward the central bank’s 2% target, reinforcing expectations that the BoJ will maintain its current monetary policy stance in the near term. The comment highlights the BoJ’s cautious approach as it monitors the economy’s recovery and price stability.

Despite recent fluctuations in consumer price data, the official emphasized that inflationary pressures are steadily building, driven by rising wage growth and domestic demand. However, the pace of progress remains moderate compared to other major economies, where central banks have adopted aggressive tightening measures to combat inflation.

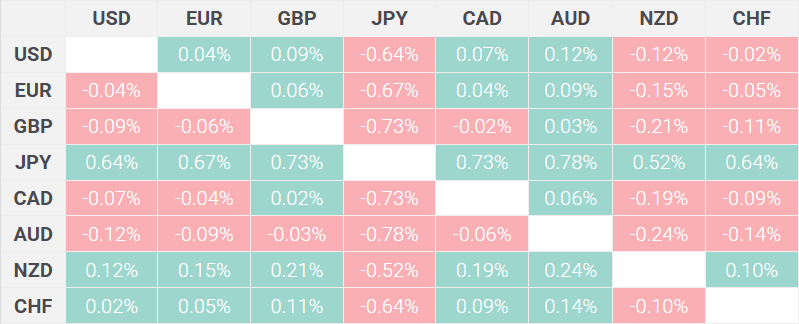

The BoJ’s commitment to its ultra-loose monetary policy has kept the Japanese yen under pressure, especially against the US dollar, as the policy gap between Japan and other economies like the US widens. Nevertheless, signs of gradual inflation growth could lead to speculation about a potential shift in the BoJ’s stance if price increases become more persistent.

Markets reacted cautiously to the BoJ’s statement, with traders closely watching for any hints of a policy pivot. The yen showed limited movement as investors await further economic data, particularly inflation and wage growth figures, to assess whether the central bank might adjust its yield curve control strategy.

For now, the BoJ remains focused on supporting economic growth while aiming for stable inflation around 2%. Unless there is a significant shift in economic conditions, the central bank is expected to maintain its current policy framework while monitoring inflation dynamics closely.