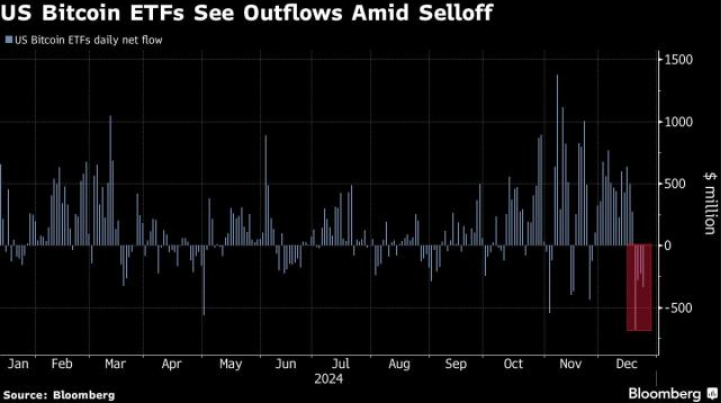

Bitcoin’s remarkable 2024 rally appears to be faltering as December outflows from US Bitcoin ETFs signal investor caution. After a year marked by soaring prices and heightened institutional interest, the cryptocurrency is facing one of its largest ETF selloffs of the year, with daily net flows turning negative by over $500 million in early December. Analysts suggest that investors may be taking profits after the token’s record-breaking highs earlier in the fourth quarter.

The selloff comes as Bitcoin’s momentum fades, with prices retreating below $40,000. Market participants have been closely monitoring macroeconomic uncertainties and regulatory developments, which are fueling a more cautious sentiment. A rise in US Treasury yields and a stronger dollar have also contributed to the pressure on risk assets like cryptocurrencies, as traders reassess their exposure heading into 2025.

While some institutional investors remain optimistic about Bitcoin’s long-term potential, the latest ETF data highlights a shift in sentiment. US-listed Bitcoin ETFs, which saw significant inflows during the mid-year rally, are now experiencing their sharpest outflows since the sector gained traction. This reversal raises questions about whether the token can sustain its dominance in the digital asset space without fresh catalysts.

Despite the recent setbacks, Bitcoin’s 2024 performance still underscores its resilience in a volatile market. The token remains up nearly 70% year-to-date, benefiting from growing adoption and the approval of spot Bitcoin ETFs earlier in the year. However, as the market closes out an extraordinary year, traders are bracing for heightened volatility as the new year approaches.