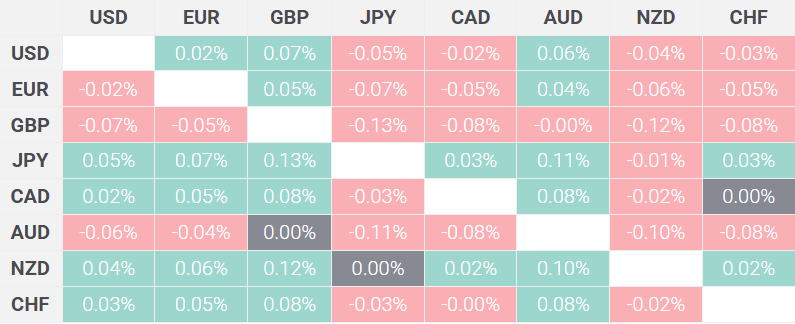

The Australian dollar maintained its position against major currencies as a resurgence in global risk appetite and supportive policy measures from China bolstered market confidence. The currency showed resilience, reflecting optimism over China’s efforts to stabilize its economy, a critical driver for Australia’s export-driven growth.

Investors reacted positively to China’s recent fiscal and monetary policy announcements aimed at boosting domestic consumption and infrastructure spending. These measures reinforced the link between Australia’s economic fortunes and China’s recovery prospects, underpinning the Aussie dollar’s stability in the short term.

Despite global headwinds, risk-on sentiment has provided additional support for the Aussie, particularly as commodity prices recover and equity markets show strength. However, analysts caution that the currency’s outlook remains tied to further developments in China’s economic trajectory and potential shifts in risk sentiment.

Market participants are closely monitoring upcoming economic data from China and Australia, which could influence sentiment further. For now, the Australian dollar benefits from a balanced narrative of optimism, though lingering uncertainties about global growth could pose challenges ahead.