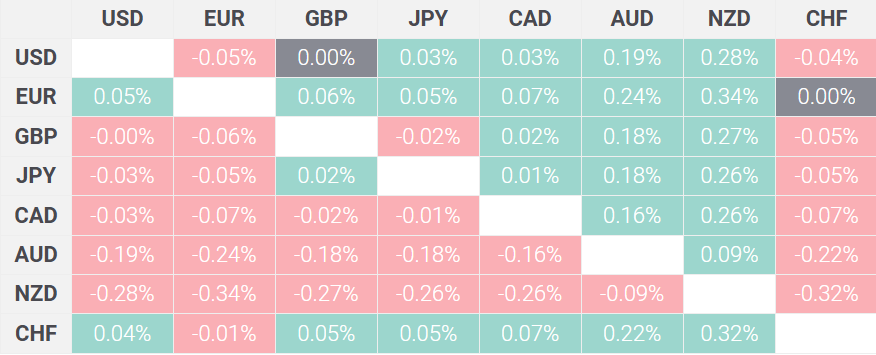

The Australian dollar remained largely subdued on Monday as markets awaited the Reserve Bank of Australia’s (RBA) upcoming interest rate decision, which is expected to provide critical clues about the country’s economic trajectory. The currency traded at US$0.6415, edging slightly lower despite a broad rally in commodity prices, which typically supports the Australian dollar due to its ties to exports such as iron ore and coal.

Analysts are divided on whether the RBA will hike rates further to combat inflation or leave them unchanged, considering that the domestic economy is showing signs of slower growth. With inflation still above the target range, the central bank faces a delicate balance between tightening monetary policy and ensuring economic stability.

Market uncertainty has added pressure on the Australian dollar, with investors cautious ahead of the RBA’s meeting tomorrow. A rate hike would likely push the currency higher, while maintaining the current stance could lead to a further decline. As traders position themselves for the outcome, the Aussie dollar remains sensitive to global market movements, including shifts in commodity prices and broader risk sentiment.

In the meantime, global attention remains fixed on other central banks, notably the US Federal Reserve, whose decisions on interest rates could also impact the Aussie dollar’s movement in the coming weeks.