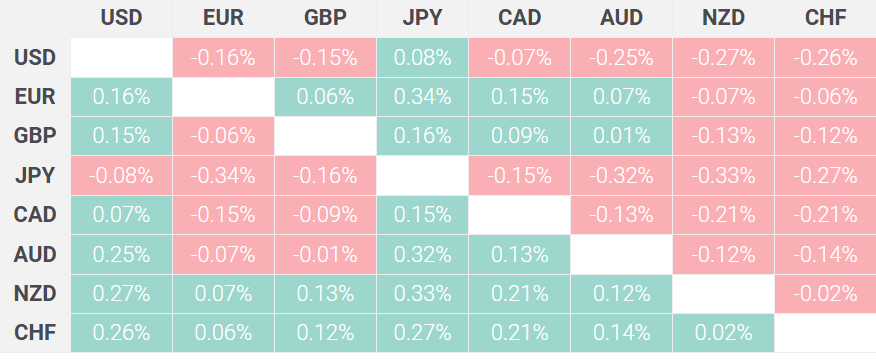

The Australian Dollar (AUD) continues to strengthen against the Japanese Yen (JPY), approaching the 98.00 mark, driven by growing optimism in the global market and signs of bullish divergence in the pair’s technical indicators. The pair has surged in recent trading sessions, largely due to a favorable risk sentiment and a rebound in global commodity prices, which benefits the AUD as a commodity-linked currency.

As the AUD/JPY tests resistance levels near 98.00, traders are eyeing key technical signals that suggest further potential for gains. The most significant of these is a bullish divergence between the price action and momentum indicators, hinting at an impending upward move. If this trend continues, the pair could break above this key level and move towards 98.50 or higher, potentially reaching its highest point in recent months.

The momentum shift comes as the global economic outlook improves, particularly in commodity markets. The Australian Dollar, benefiting from its ties to commodities like iron ore and gold, has seen a rebound. Meanwhile, the Japanese Yen remains under pressure due to Japan’s ongoing monetary policy stance, which maintains low interest rates to support its economy.

Traders and investors are advised to monitor developments in global risk sentiment and economic data releases, as these factors could impact the AUD/JPY outlook in the short term. While the technical setup suggests bullish momentum, any unexpected market shifts could lead to increased volatility around key resistance levels.