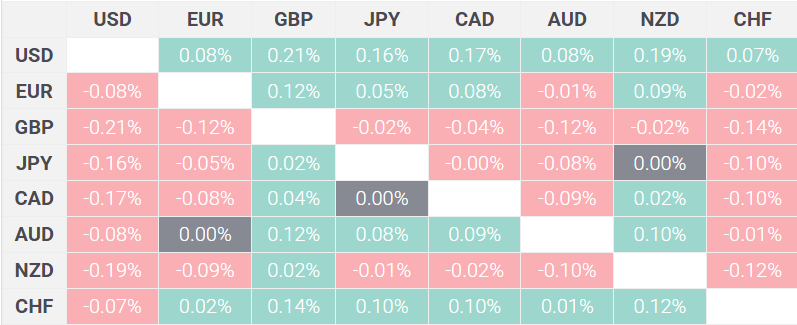

The Australian dollar continued its decline, pressured by increasing speculation that the Reserve Bank of Australia (RBA) may implement a rate cut in the near term. Weak domestic economic data and slowing consumer spending have heightened expectations for a policy shift, pushing the currency lower in global trading.

The US dollar’s strength has added to the Aussie’s struggles, with investors awaiting the highly anticipated US non-farm payrolls (NFP) report for clues on Federal Reserve policy. Strong job data could reinforce the Fed’s hawkish stance, further widening the interest rate differential and weighing on the Australian dollar.

Analysts note that concerns over Australia’s economic resilience, coupled with external factors such as weak commodity prices, have compounded the currency’s recent losses. Speculation around the RBA’s dovish pivot has also triggered risk-off sentiment, with traders scaling back positions in the Australian dollar.

The Aussie’s outlook remains uncertain, with market participants closely monitoring the upcoming US labor market data and RBA policy developments. While the dollar’s current trajectory points to further weakness, any surprises in key economic indicators could shift market sentiment quickly.