The Australian Dollar (AUD) slipped on Tuesday, surprising markets that anticipated support from the Reserve Bank of Australia’s (RBA) hawkish policy signals. Despite the RBA’s indication of potential interest rate hikes to address inflation, the currency faltered as investors shifted their focus to upcoming inflation data, which may further clarify the central bank’s next steps.

While the RBA’s stance pointed toward an aggressive approach on rates, the AUD’s performance suggests caution among traders waiting to see if inflation figures will confirm the need for such action. If inflation remains high, the RBA may pursue further rate increases, potentially supporting the AUD over the longer term.

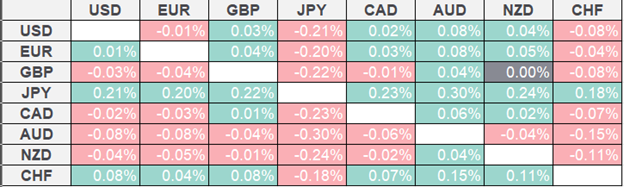

Broader factors, including a strong U.S. dollar and mixed global risk sentiment, also contributed to the AUD’s decline. Rising U.S. Treasury yields have made the U.S. dollar more attractive, adding pressure on the AUD. Additionally, concerns over global economic conditions have weighed on the Australian Dollar, which is particularly responsive to shifts in global market sentiment due to Australia’s dependence on commodity exports.

(Source: FXStreet)

With inflation data on the horizon, the AUD’s recent movement reflects a cautious outlook from investors. The currency’s response to the data could reveal investor confidence in the RBA’s strategy to tackle inflation amid domestic economic challenges and fluctuating global conditions.