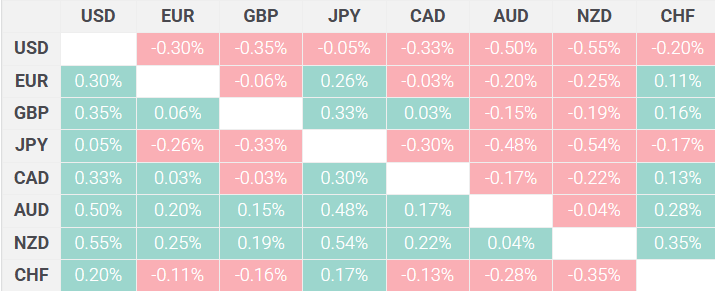

The GBP/USD pair climbed near the 1.2400 level, driven by renewed dollar weakness after former President Donald Trump publicly urged the Federal Reserve to lower interest rates. This appeal reignited debates about the central bank’s independence and added pressure on the dollar, favoring rival currencies like the British pound.

Market sentiment shifted as traders speculated on the likelihood of monetary easing, which could weigh further on the greenback. The pound’s strength also found support in anticipation of steady Bank of England policy amid an improving UK economic outlook. However, the pair’s upward trajectory remains capped by lingering uncertainties surrounding US monetary policy and global growth concerns.

Trump’s remarks amplified existing volatility in financial markets, with investors recalibrating expectations for US interest rates. The Fed has signaled a cautious approach to rate adjustments, but political pressures, combined with signs of slowing growth, may tilt the balance toward further easing.

For GBP/USD, sustaining gains near 1.2400 will hinge on upcoming economic data from both the UK and the US, as well as signals from the Fed’s upcoming policy meetings. Any divergence between central bank strategies could further influence the pair’s direction, keeping traders on edge.