The Australian Dollar (AUD) strengthened on renewed market volatility after Donald Trump urged the Federal Reserve to lower interest rates. His comments added pressure on the central bank to adopt a more dovish stance, shaking confidence in the U.S. dollar and spurring demand for alternative currencies like the AUD.

Investors interpreted Trump’s remarks as a signal of potential political interference in monetary policy, unsettling markets already grappling with global economic uncertainties. The AUD’s appreciation reflects broader concerns over the U.S. economic outlook, with traders seeking refuge in currencies linked to resource-heavy economies like Australia.

The Federal Reserve’s response remains uncertain, with policymakers maintaining that monetary decisions will hinge on economic data rather than political influence. However, Trump’s push for rate cuts could amplify existing debates over the central bank’s independence, creating further headwinds for the U.S. dollar in the short term.

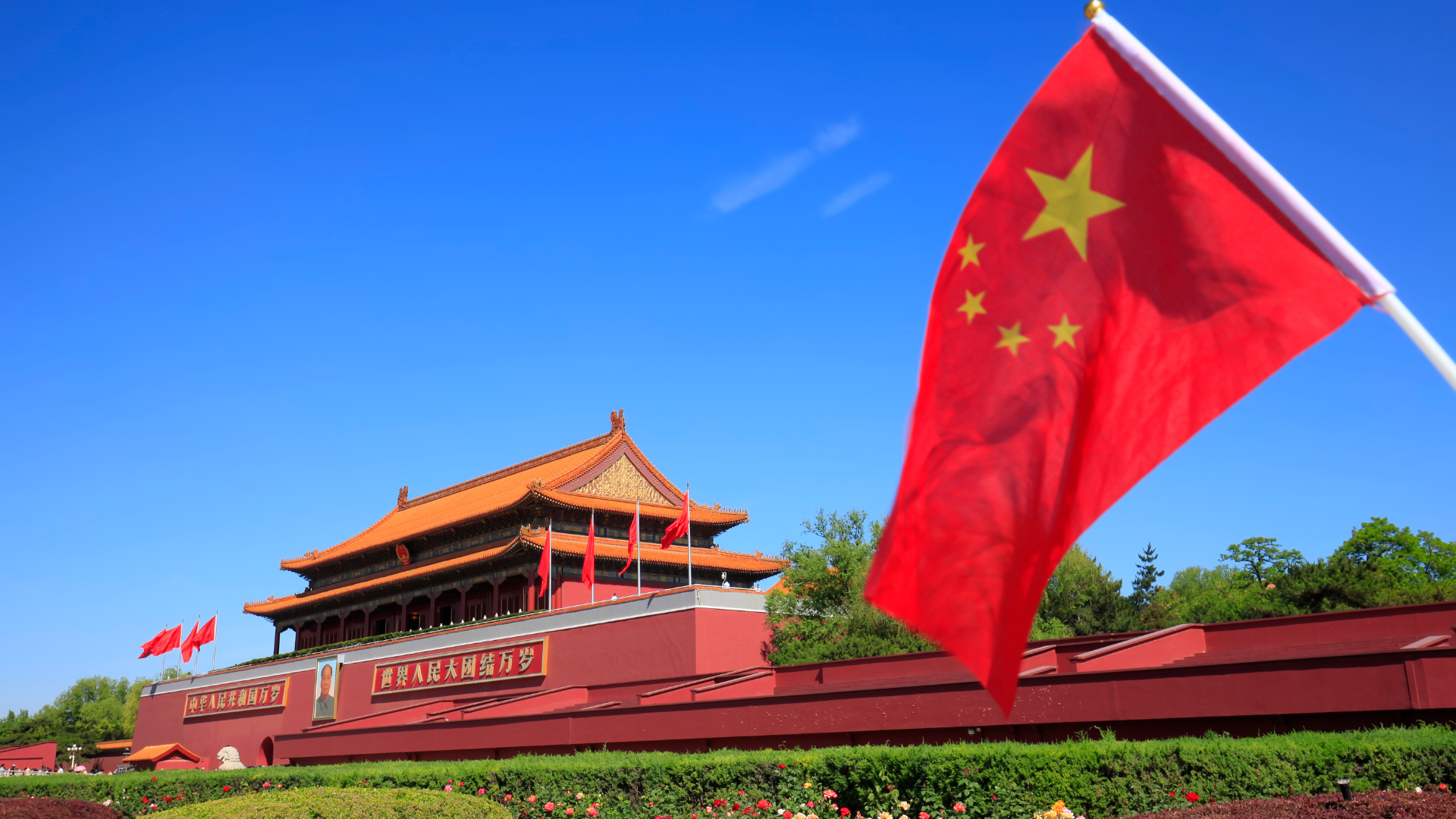

While the Australian Dollar capitalized on the greenback’s weakness, analysts caution that its gains may be short-lived. The AUD’s sensitivity to global trade dynamics and China’s economic performance could limit its upward trajectory, keeping the focus on upcoming economic data and policy signals.